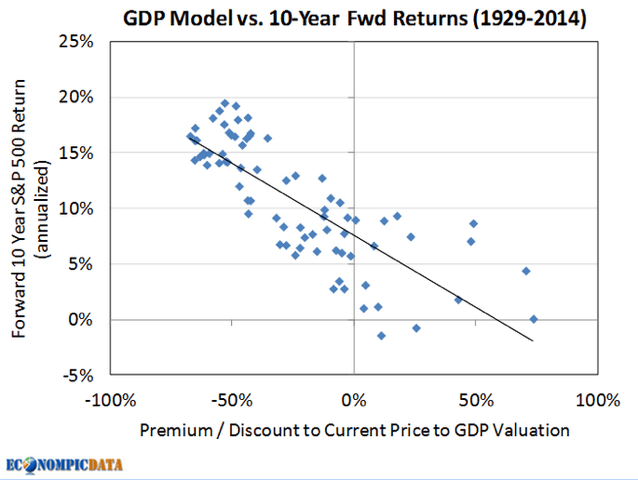

Good morning. Some thoughts on the connection between GDP growth and stock market returns

http://econompicdata.blogspot.nl/2015/04/is-there-relationship-between-economy.html

The IMF has looked at investment funds and illiquidity

http://www.imf.org/external/pubs/ft/survey/so/2015/pol040815b.htm

Contrary what the title of the post suggests: this is a pretty boring chart

http://uk.businessinsider.com/chinese-broad-money-growth-is-now-slower-than-the-us-slowdown-2015-4

Can someone spot the pattern?

http://uk.businessinsider.com/markets-charts-of-the-day-april-8-2015-4

Under the heading of Secular Stagnation (from Bruegel)

http://www.bruegel.org/nc/blog/detail/article/1603-secular-stagnation-and-capital-flows/

I missed this one on Robotics: takes 6 minutes to watch and then you are up to speed on the subject (via http://www.oneworld.nl/blog/de-week-tweets/de-week-van-went-tweets-52)

http://video.ft.com/4147651613001/Automation-jobs-and-history/World

In absolute (and relative growth) numbers, Emerging markets will be greying faster than developing markets

http://www.thefinancialist.com/developing-economies-graying-faster/

A complete overview of all previous editions of Best of the Web can be found herehttp://tinyurl.com/c8ge4c5. All links provided are collected from public websites, unless otherwise specified. I have not checked the data or information for accuracy used, and therefore do not guarantee that all data provided will be 100% correct. The links provided do not necessarily reflect my personal opinion and should be seen as general interest: oftentimes I do not agree with arguments presented, but nevertheless think it is worthwhile to read them. It is up to the reader to make up their own mind. Suggestions or discussions are more than welcome. Do not quote unless specifically cleared beforehand!