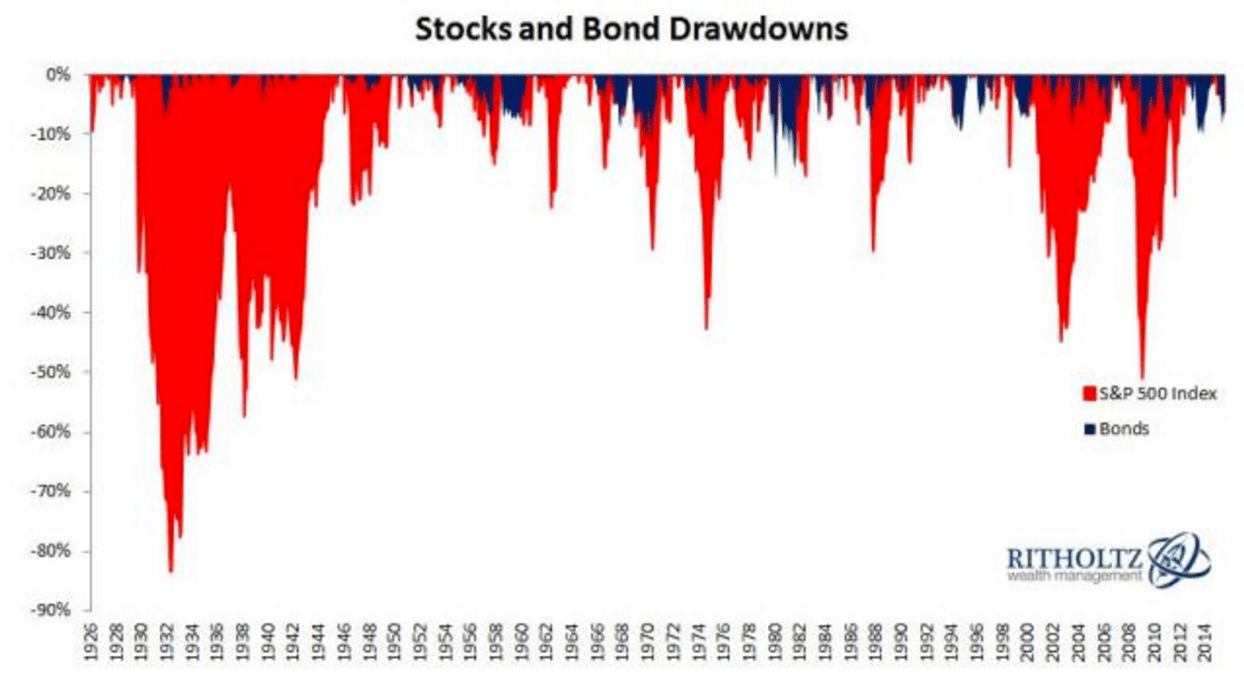

Good morning. Nice one: your maximum loss in bonds versus stocks

https://theirrelevantinvestor.wordpress.com/2015/10/15/dry-powder/

Ten super Dilberts: spot your own favorite!

http://uk.businessinsider.com/best-dilbert-comics-2015-10

Test your skills as a market timer!

http://www.bloomberg.com/features/2015-stock-chart-trading-game/

I only believe this chart if I get to see the same chart with the dot on the top, one year ago

http://ftalphaville.ft.com/2015/10/20/2142521/your-updated-guide-to-being-an-em-fx-bull-now-with-bonus-prayer/

A presentation by Brad Delong, who is basically asking a lot of questions

http://www.bradford-delong.com/2015/10/macro-situation-how-many-bullets-can-the-economy-dodge.html

Earnings power for Japanese equities is weak. Why?

http://www.voxeu.org/article/poor-earning-power-japanese-firms

Interesting factoid: how the S&P500 breaks down in credit quality

http://uk.businessinsider.com/speculative-grade-companies-in-the-sp-500-2015-10

The lending standards in Eurozone have generally eased

https://www.ecb.europa.eu/stats/pdf/blssurvey_201510.pdf?c26d6bcb68a8ff4591521d35ccc0abcd

Interesting

http://uk.businessinsider.com/hasbro-foreign-currency-star-wars-2015-10

Portfolio investments are almost as big as the current account

http://www.ecb.europa.eu/press/pr/stats/bop/2015/html/bp151020.en.html

A complete overview of all previous editions of Best of the Web can be found herehttp://tinyurl.com/c8ge4c5. All links provided are collected from public websites, unless otherwise specified. I have not checked the data or information for accuracy used, and therefore do not guarantee that all data provided will be 100% correct. The links provided do not necessarily reflect my personal opinion and should be seen as general interest: oftentimes I do not agree with arguments presented, but nevertheless think it is worthwhile to read them. It is up to the reader to make up their own mind. Suggestions or discussions are more than welcome. Do not quote unless specifically cleared beforehand!