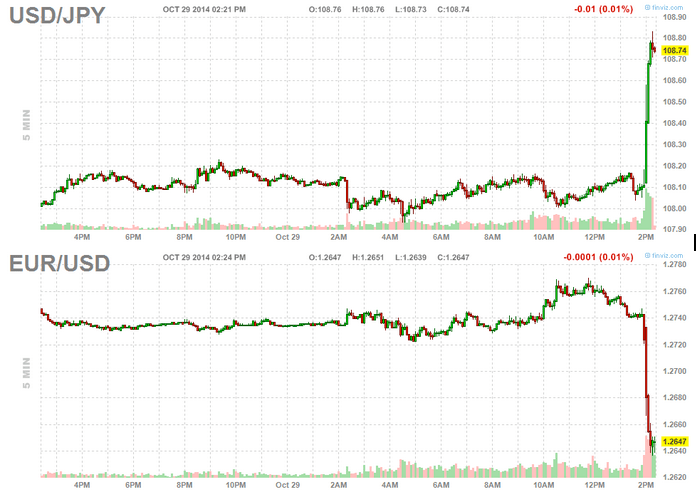

Good morning. This is what the end of QE looks like in currency markets..

http://www.businessinsider.com/dollar-rallies-after-qe-end-2014-10

Market psychology…

http://theirrelevantinvestor.tumblr.com/post/101200549638/the-stock-market-bottomed-ten-days-ago-it-feels

One of the more important European statistics around: the bank lending survey

https://www.ecb.europa.eu/stats/pdf/blssurvey_201410.pdf?2c94dc05dc5cd40aadb6f077dc320999

Some interesting charts from the IIF on bank lending emerging markets. It does not sound like a bullish story…

http://blogs.ft.com/beyond-brics/2014/10/30/iif-bank-lending-report-adds-to-gloom-over-emerging-markets/

And some more from the ECB stress test

https://www.bondvigilantes.com/blog/2014/10/29/happy-halloween-time-scary-charts/

Morgan Stanley is not too concerned about US margins

http://www.businessinsider.com/ms-why-profit-margins-wont-mean-revert-2014-10

A bit of reading on global imbalances…

http://www.voxeu.org/article/narrowing-global-imbalances

Krugman has some thoughts on Japan. As usual, the further he goes away from US economics, the less interesting his comments are.

http://krugman.blogs.nytimes.com/2014/10/28/notes-on-japan/

Your guide to living longer. Or not.

http://www.ritholtz.com/blog/2014/10/guide-to-longer-living-through-science/

A complete overview of all previous editions of Best of the Web can be found herehttp://tinyurl.com/c8ge4c5. All links provided are collected from public websites, unless otherwise specified. I have not checked the data or information for accuracy used, and therefore do not guarantee that all data provided will be 100% correct. The links provided do not necessarily reflect my personal opinion and should be seen as general interest: oftentimes I do not agree with arguments presented, but nevertheless think it is worthwhile to read them. It is up to the reader to make up their own mind. Suggestions or discussions are more than welcome. Do not quote unless specifically cleared beforehand!