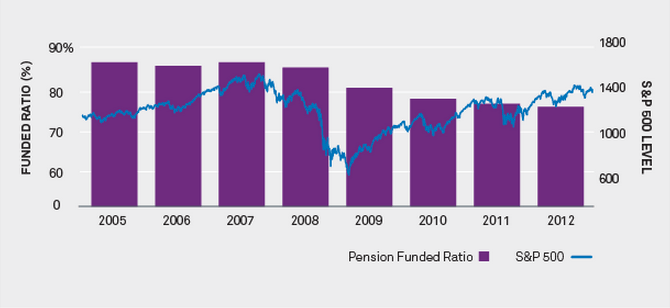

Good morning. Well, you won’t be able to say I didn’t warn you. Pension funding: the next big ‘challenge’

http://www.businessinsider.com/art-cashin-gold-structured-products-2013-4

…and this one is pretty clear as well: “the train wreck awaiting American retirement”

http://www.pbs.org/wgbh/pages/frontline/business-economy-financial-crisis/retirement-gamble/john-bogle-the-train-wreck-awaiting-american-retirement/

The US earnings season so far: mediocre, especially on revenue

http://www.bespokeinvest.com/thinkbig/2013/4/24/mediocre-earnings-and-revenues.html

European banks are still tightening on credit conditions. Mostly on account of the economy

http://www.ecb.europa.eu/stats/pdf/blssurvey_201304.pdf?f07fccdb7ead1e8db63651918e6c9b92

The most surprising thing about this chart is not the level of buybacks, but rather the poor timing of companies to do so…

http://www.businessinsider.com/market-rally-buybacks-and-dividends-2013-4

All you ever wanted to know about Slovenia -but were afraid to ask. With nice looking charts and all!

http://ftalphaville.ft.com/2013/04/24/1469552/a-slovenia-qa/

Tech stocks, overpriced no more!

http://www.economist.com/blogs/graphicdetail/2013/04/daily-chart-16

HA! HA! HA! This one is up for the-dumbest-line-ever-drawn-competition! My 3 year old daughter is the only challenger so far…

http://www.zerohedge.com/contributed/2013-04-24/one-line-watch-where-gold-heading

A complete overview of all previous editions of Best of the Web can be found here http://tinyurl.com/c8ge4c5. All links provided are collected from public websites, unless otherwise specified. I have not checked the data or information for accuracy used, and therefore do not guarantee that all data provided will be 100% correct. The links provided do not necessarily reflect my personal opinion and should be seen as general interest: oftentimes I do not agree with arguments presented, but nevertheless think it is worthwhile to read them. It is up to the reader to make up their own mind. Suggestions or discussions are more than welcome. Do not quote unless specifically cleared beforehand!

Amazing graph on share buybacks. But what is the alternative? CFO’s would have to predict their own share price …

Well, if CFO’s are supposed to be able to assess whether a takeover of a rival is worth it or not, than why should they not be able to have a better knowledge on the price of their own stock? Unlike the rest of us, they have all the information at hand to make the right assessment…