Bracing for Sandy… “NYSE TRADING FLOOR TO CLOSE TOMORROW; ALL TRADING TO BE ON ARCA”

Green shoots for the Chinese economy, or wishful thinking?

(source: http://www.businessinsider.com/chart-chinese-stocks-versus-gdp-2012-10)

And here is another article on the China turnaround story.

Realistically pessimistic article in the Washington Post about Japan…

And yet another interesting read, this time about the (un)usefulness of inflation to reduce government debt

High Yield bonds are expecting something stocks are not expecting?

For al ye ETF lovers out there!

Bubble or not: inflow into Emerging Market Debt has dwarfed that of Emerging Markets Equity

· http://www.businessinsider.com/emerging-markets-debt-bubble-2012-10

Finally some good news on bank deposits in Greece and Spain: deposit outflow reverses somewhat. It could be a seasonal factor though

· http://www.ft.com/intl/cms/s/0/2a4fc628-1e81-11e2-bebc-00144feabdc0.html

A chart showing the Foreign Direct Investments in recent years. Looks like volatile data: what has boosted FDI into France for example?

· http://www.businessinsider.com/global-foreign-direct-investment-flows-2012-10

Good (although one week old) summery on the discussion whether economic recoveries are different following financial recessions or not

· http://noahpinionblog.blogspot.nl/2012/10/reinhart-rogoff-vs-bordo-haubrich-with.html

And of course, the schedule of the week to come

Nice one: the complete overview of real GDP growth under the various US Presidents…

· http://www.businessinsider.com/best-and-worst-presidents-for-gdp-growth-2012-10

…and this is the same idea but than for stock market returns

· http://www.bespokeinvest.com/thinkbig/2012/10/22/equity-markets-under-obama.html

“Oil and the World Economy: Some Possible Futures” Technical study by the IMF

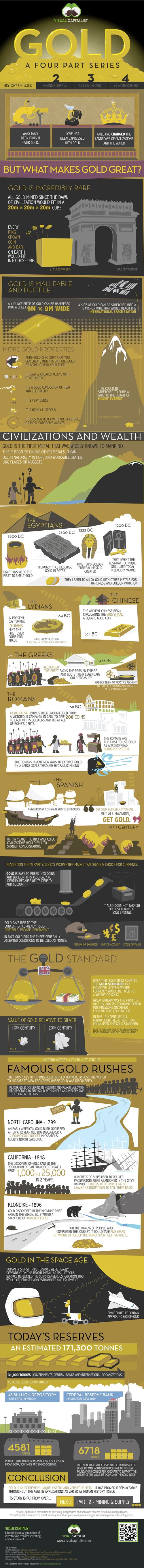

Gigantic infographic on Gold.

· http://www.businessinsider.com/history-of-gold-infographic-2012-10

A complete overview of all previous editions of Best of the Web can be found here http://tinyurl.com/yb9e5dg. All links provided are collected from public websites, unless otherwise specified. I have not checked the data or information for accuracy used, and therefore do not guarantee that all data provided will be 100% correct. The links provided do not necessarily reflect my personal opinion and should be seen as general interest: oftentimes I do not agree with arguments presented, but nevertheless think it is worthwhile to read them. It is up to the reader to make up their own mind. Suggestions or discussions are more than welcome. Do not quote unless specifically cleared beforehand!

That hasn’t happened for over a decade. Or so I thought. Until recently, the official statistics showed that investment made the biggest contribution to China’s growth in every year since 2001. But earlier this week the new edition of the China Statistical Yearbook arrived on my desk with a thud. Its revised figures show that consumption contributed 55.5% of China’s growth in 2011; investment contributed only 48.8%. (Net exports subtracted 4.3%.) In other words, China’s growth was consumption-led last year as well.- Ik houd niet van complotdenken. Maar de chinese overheid wil graag de groei van de economie vanuit consumptie sinds het laatste 5 jarenplan en POEF opeens laten de statistieken dit ook zien ? Hoe betrouwbaar is dat dan ?

De Chinese statistieken zijn notoir onbetrouwbaar, dus ook die cijfers van de samenstelling moet je met een redelijke theelepel zout nemen.Dus nee, onbetrouwbaar.