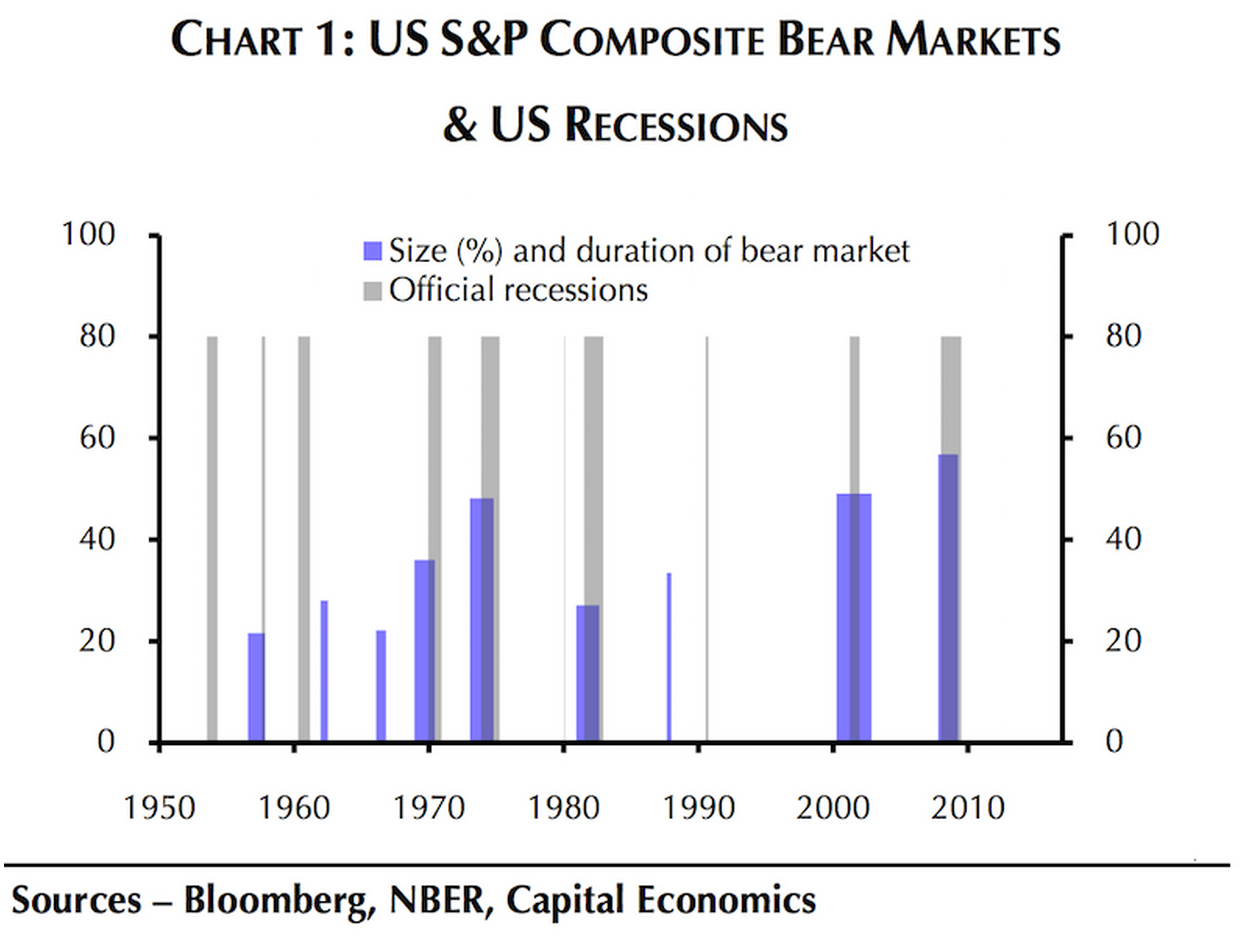

Good morning. I like this chart, showing the link between recessions and bear markets. Certainly no perfect match…

http://uk.businessinsider.com/sp-500-bear-markets-and-recessions-2015-8

And here we go again: 2015 is just like… 1998!

http://uk.businessinsider.com/goldman-sachs-us-stocks-surging-back-like-1998-china-black-monday2015-8

Which -of course- is pretty dumb thing to say (in Dutch, my column in Het Financieele Dagblad)

http://fd.nl/beurs/1116254/paniek-in-de-tent

The volatility in volatility

http://www.ritholtz.com/blog/2015/08/something-in-china/

More damage… “Questions over Li Keqiang’s future amid China market turmoil”

http://www.ft.com/intl/cms/s/0/15c0be40-4b21-11e5-b558-8a9722977189.html

On why the Chinese stock market correction may be different this time

http://ftalphaville.ft.com/2015/08/25/2138457/why-chinas-stock-market-implosion-might-not-be-very-meaningful/

Sure, you get the best returns in a deep, deep crisis. But are we in a deep, deep crisis, then?

https://www.fidelity.com/viewpoints/investing-ideas/strategies-for-volatile-markets

Ah, a bit on High Yield exposure on Emerging Markets

https://www.bondvigilantes.com/blog/2015/08/25/commodity-carnage-mayhem-exposed-high-yield-markets/

Go Africa! Go!

http://www.economist.com/blogs/graphicdetail/2015/08/daily-chart-10

A complete overview of all previous editions of Best of the Web can be found herehttp://tinyurl.com/c8ge4c5. All links provided are collected from public websites, unless otherwise specified. I have not checked the data or information for accuracy used, and therefore do not guarantee that all data provided will be 100% correct. The links provided do not necessarily reflect my personal opinion and should be seen as general interest: oftentimes I do not agree with arguments presented, but nevertheless think it is worthwhile to read them. It is up to the reader to make up their own mind. Suggestions or discussions are more than welcome. Do not quote unless specifically cleared beforehand!