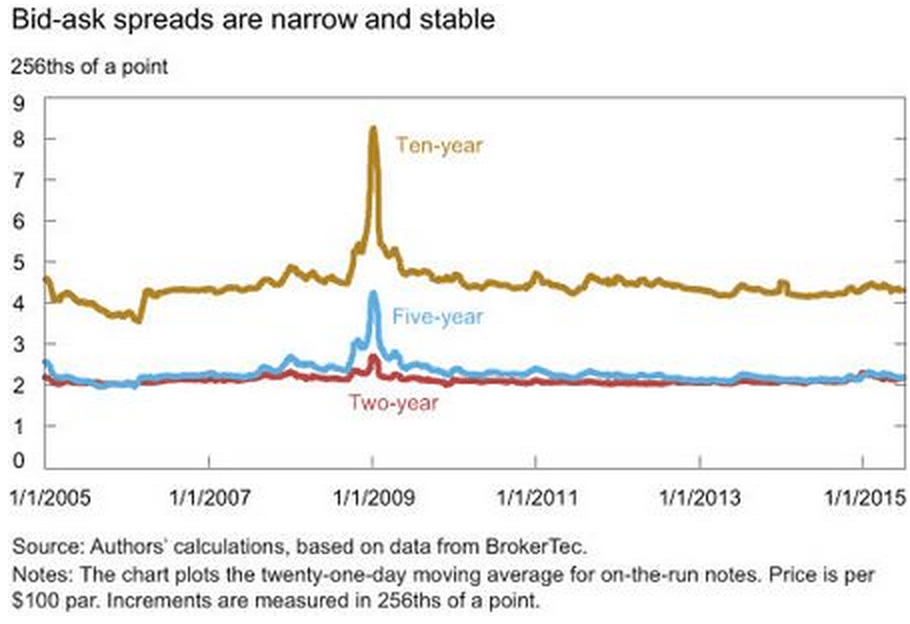

Good morning. Is there, or is there not a liquidity problem in bond markets? Here is the fed’s answer

http://libertystreeteconomics.newyorkfed.org/2015/08/has-us-treasury-market-liquidity-deteriorated.html#.VdMvnWf1SzE

There is a big study by McKinsey on the Internet of Things

http://www.mckinsey.com/insights/business_technology/an_executives_guide_to_the_internet_of_things

China unrest is rising… (via @leonmwc)

Who killed Value? A bit of reading on why value stocks have underperformed.

http://www.efficientfrontier.com/ef/701/value.htm

And here is another bit of reading on the same subject: value stocks are set to stage a comeback

http://www.advisorperspectives.com/articles/2015/08/11/why-you-should-allocate-to-value-over-growth

There is only one way to make this chart work: there must have been an explosion of new cities starting 1515

http://www.voxeu.org/article/media-markets-and-institutional-change-evidence-protestant-reformation

Just some light entertainment…

http://www.washingtonpost.com/news/wonkblog/wp/2015/08/18/the-most-unrealistic-thing-about-hollywood-romance-visualized/

Whatever happened to the Netherlands in this chart???

http://uk.businessinsider.com/this-one-graphic-shows-how-much-an-iphone-costs-around-the-world-and-theres-a-big-difference-2015-8

A complete overview of all previous editions of Best of the Web can be found herehttp://tinyurl.com/c8ge4c5. All links provided are collected from public websites, unless otherwise specified. I have not checked the data or information for accuracy used, and therefore do not guarantee that all data provided will be 100% correct. The links provided do not necessarily reflect my personal opinion and should be seen as general interest: oftentimes I do not agree with arguments presented, but nevertheless think it is worthwhile to read them. It is up to the reader to make up their own mind. Suggestions or discussions are more than welcome. Do not quote unless specifically cleared beforehand!