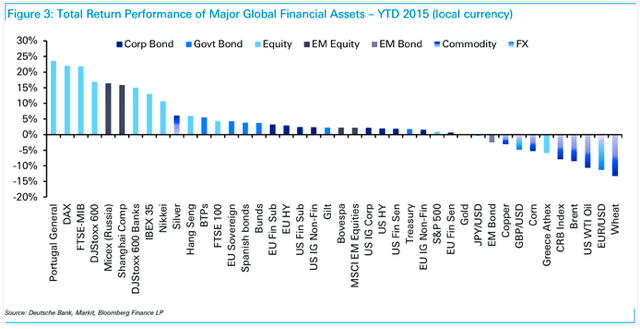

Good morning. And that was Q1! Should have bought Portugal…

http://uk.businessinsider.com/return-performance-of-major-global-financial-assets-q1-2015-2015-4

More signs of the Chinese economic slowdown

http://uk.businessinsider.com/analyst-chinas-economy-just-touched-the-governments-chilling-red-line-2015-4

…while we are all interested to see whether this relationship (with a nine months lead) will hold this time

http://uk.businessinsider.com/mcdonalds-wage-increase-2015-4

On labour and capital shares and why the US is different from the rest

http://blogs.ft.com/andrew-smithers/2015/04/has-labour-lost-out-to-capital/

How much higher can the inventories go…?

https://www.bespokepremium.com/think-big-blog/record-streak-of-crude-oil-inventory-increases/

And here is part two of the Bernanke sequel!

http://www.brookings.edu/blogs/ben-bernanke/posts/2015/03/31-why-interest-rates-low-secular-stagnation

New innovation from the OECD: how does your country compare to… I can’t access it though

http://www.oecd360.org/oecd360/

A complete overview of all previous editions of Best of the Web can be found herehttp://tinyurl.com/c8ge4c5. All links provided are collected from public websites, unless otherwise specified. I have not checked the data or information for accuracy used, and therefore do not guarantee that all data provided will be 100% correct. The links provided do not necessarily reflect my personal opinion and should be seen as general interest: oftentimes I do not agree with arguments presented, but nevertheless think it is worthwhile to read them. It is up to the reader to make up their own mind. Suggestions or discussions are more than welcome. Do not quote unless specifically cleared beforehand!