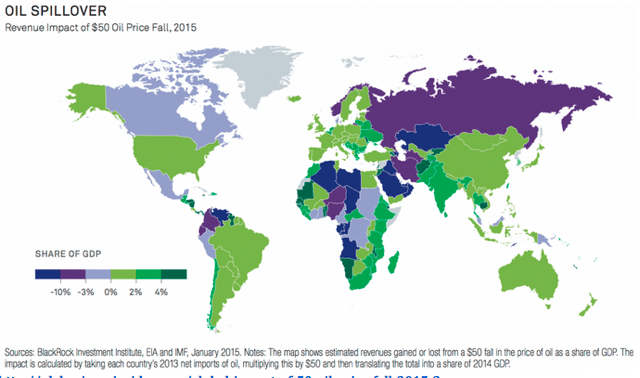

Good morning. This one is a bit old, but thanks to Presidents Day I put it up

http://uk.businessinsider.com/global-impact-of-50-oil-price-fall-2015-2

Kill the financial sector and double productivity growth… Or something like that

http://ftalphaville.ft.com/2015/02/16/2119138/crush-the-financial-sector-end-the-great-stagnation/

Some ‘state of the art’ research that shows that lower growth is related to a drop in labour productivity

http://www.voxeu.org/article/tracking-gdp-when-long-run-growth-uncertain

US consumers are not spending their oil price windfall as expecetd…

http://uk.businessinsider.com/us-consumers-are-spending-less-gas-savings-2015-2

Just go for the Asian and European returns and leave the US markets. 🙂 (but why does this chart stop at 2007…?)

http://www.ritholtz.com/blog/2015/02/10-presidents-day-reads/

UK -although outperforming in Europe- is still in a very weak growth recovery…

http://uk.businessinsider.com/italy-is-failing-to-learn-the-uks-lessons-on-austerity-2015-2

A complete overview of all previous editions of Best of the Web can be found herehttp://tinyurl.com/c8ge4c5. All links provided are collected from public websites, unless otherwise specified. I have not checked the data or information for accuracy used, and therefore do not guarantee that all data provided will be 100% correct. The links provided do not necessarily reflect my personal opinion and should be seen as general interest: oftentimes I do not agree with arguments presented, but nevertheless think it is worthwhile to read them. It is up to the reader to make up their own mind. Suggestions or discussions are more than welcome. Do not quote unless specifically cleared beforehand!