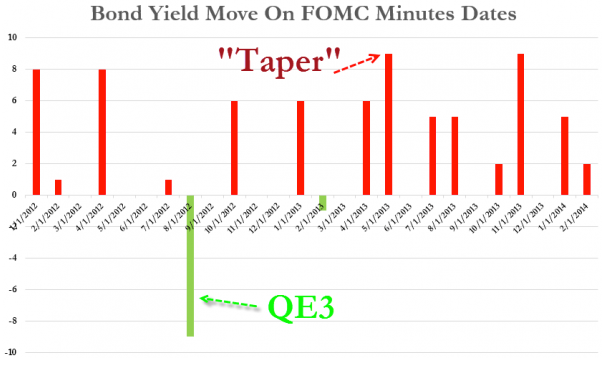

Good morning. One day late, but still worth it to show it: normally, bond markets sell off on days of FOMC releases…

….but not so, yesterday (third chart)

http://www.zerohedge.com/news/2014-04-09/vix-slammed-dow-recovers-post-fomc-losses

The Financial Stability review by the IMF. I always wonder whether this is forward or backward looking…

http://www.imf.org/External/pubs/FT/GFSR/2014/01/pdf/text.pdf

In case you missed it, Piketty is the hot thing right now. Piketty? Here is “the short guide to Capital in the 21st Century”

http://www.vox.com/2014/4/8/5592198/the-short-guide-to-capital-in-the-21st-century

Another worrying sign: companies are releveraging…

http://www.zerohedge.com/news/2014-04-09/citi-warns-leverage-clock-ticking

…and remember: corrections are just part of the game. According to Goldman there is a 67% chance for a 10% correction this year

http://www.zerohedge.com/news/2014-04-09/goldman-warns-67-odds-10-market-decline-next-year

Can this be true…? The relative performance of various funds after a morning star rating.

http://www.businessinsider.com/financial-advisor-insights-april-9-2014-4

And another bullish story about the upcoming capex boom

http://soberlook.com/2014/04/capex-about-to-accelerate-4-key-reasons.html

Women have been steadily closing the gap with men…

http://www.washingtonpost.com/blogs/wonkblog/wp/2014/04/08/the-end-of-men-in-one-chart/

The diverging fortunes of the old Russian satellites

http://www.economist.com/blogs/graphicdetail/2014/04/daily-chart-5

A complete overview of all previous editions of Best of the Web can be found herehttp://tinyurl.com/c8ge4c5. All links provided are collected from public websites, unless otherwise specified. I have not checked the data or information for accuracy used, and therefore do not guarantee that all data provided will be 100% correct. The links provided do not necessarily reflect my personal opinion and should be seen as general interest: oftentimes I do not agree with arguments presented, but nevertheless think it is worthwhile to read them. It is up to the reader to make up their own mind. Suggestions or discussions are more than welcome. Do not quote unless specifically cleared beforehand!