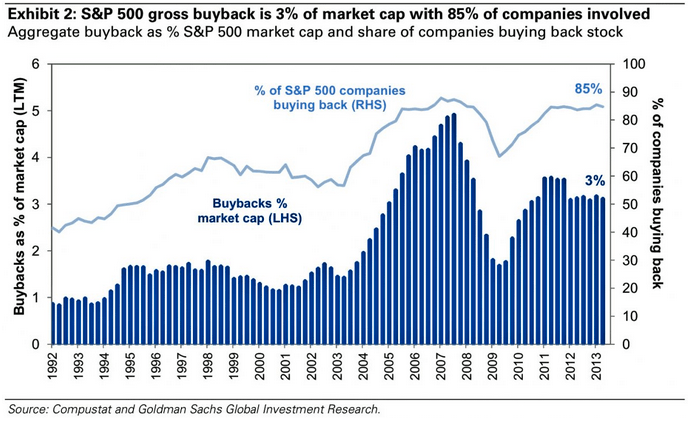

Good morning. This one is nice: S&P500 buybacks in historic perspective

http://www.businessinsider.com/sp-500-stock-buyback-history-2014-4

…which is interesting, if you take the share count of this chart into account. In other words, NET buybacks have been far less supportive

http://www.businessinsider.com/chart-sources-of-eps-growth-2014-4

Corporate debt as percentage of GDP: Asia looks stretched…

http://www.zerohedge.com/news/2014-04-05/how-much-bad-debt-can-china-absorb

Hey! I have been named Dutch Investment Opinion Influential of 2014!!

http://www.iexprofs.nl/Column/Nieuws-Beurs-vandaag/117439/Dijsselbloem-meest-invloedrijk.aspx

US private employment has regained all of its losses. Or has it?

http://www.calculatedriskblog.com/2014/04/wsj-employment-graph-ignores.html

Interesting chart showing how UK and US bond yields have taken a lead over German yields

http://www.bondvigilantes.com/blog/2014/04/04/power-duration-contemporary-example/?

Best of last week. As always.

https://lukasdaalder.com/2014/04/04/best-in-economics-this-week-april-4/

A bit of history on economic freedom

http://www.voxeu.org/article/economic-liberty-long-run-evidence-oecd-countries

More and more signs that the high yield market is weakening…

http://online.wsj.com/news/articles/SB10001424052702303847804579477850200373262

Well, this one is interesting! Why has there been such a tight fit, pray wonder?

http://ftalphaville.ft.com/2014/04/04/1820672/if-only-we-had-known/

The rise of mutual funds… Some info.

http://ftalphaville.ft.com/2014/04/04/1820742/the-age-of-asset-management/

The schedules for the week ahead.

http://blogs.ft.com/beyond-brics/2014/04/06/the-week-ahead-april-6-13/

http://www.calculatedriskblog.com/2014/04/schedule-for-week-of-april-6th.html

Ah well…

http://www.zerohedge.com/news/2014-04-06/summing-american-dream-one-cartoon

A complete overview of all previous editions of Best of the Web can be found herehttp://tinyurl.com/c8ge4c5. All links provided are collected from public websites, unless otherwise specified. I have not checked the data or information for accuracy used, and therefore do not guarantee that all data provided will be 100% correct. The links provided do not necessarily reflect my personal opinion and should be seen as general interest: oftentimes I do not agree with arguments presented, but nevertheless think it is worthwhile to read them. It is up to the reader to make up their own mind. Suggestions or discussions are more than welcome. Do not quote unless specifically cleared beforehand!

Hi,kon meest invloedrijke beleggingsopiniemaker niet openen,iT is a pity!Ilja