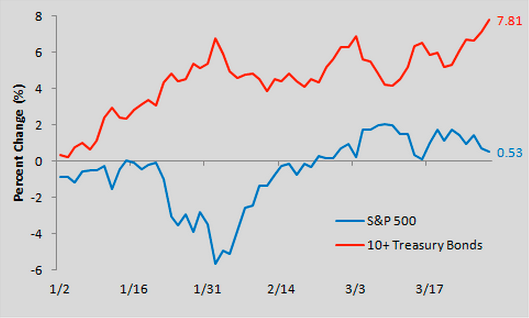

Good morning.Bonds vs Stocks: 1-0. Of course, that is only for Q1…

http://www.bespokeinvest.com/thinkbig/2014/3/28/bonds-trounce-stocks-in-q1.html

…but fear not! April is the best month for stocks…

http://www.zerohedge.com/news/2014-03-30/stocks-april-least-cruel-month

Capital spending: will it finally take place…????

http://ftalphaville.ft.com/2014/03/28/1812892/the-capex-call/

Financial Times: “Weidmann plays tactical game with moderation of tone on ECB policy”

http://www.ft.com/intl/cms/s/0/2af1c3de-b7f4-11e3-af5e-00144feabdc0.html

Best of Last week. Well, at least my tai on it…

https://lukasdaalder.com/2014/03/28/best-in-economics-this-week-march-28/

There is at least one sector that has the M&A fantasy as support…

http://www.bloombergview.com/articles/2014-03-28/ritholtz-s-10-friday-reads-lehman-ncaa-and-government-motors

Another interesting chart, showing the differences in corporate culture (or maybe accounting standards) between the US and Japan

http://www.businessinsider.com/buybacks-dividends-capex-and-japan-2014-3

Cool chart: the increasing importance of foreign profits for US companies

http://www.washingtonpost.com/news/rampage/wp/2014/03/27/whats-good-for-general-motors-may-no-longer-depend-on-the-u-s/

The big question here is: can we trust macro data from China, ever.

http://www.businessinsider.com/chinese-private-sector-debt-2014-3

Interest rates of 3%: it is hard to believe right now…

http://feedly.com/index.html#category%2FThe%20Big%20Picture

It is not the 1% that is outperforming. it’s the 0.01%…

http://www.businessinsider.com/the-wealth-of-the-top-1-percent-decomposed-2014-3

Pictures on the California drought

http://www.theatlantic.com/infocus/2014/03/californias-historic-drought/100706/

Schedules…. The world might be a better place without them

http://www.calculatedriskblog.com/2014/03/schedule-for-week-of-march-30th.html

http://blogs.ft.com/beyond-brics/2014/03/30/the-week-ahead-march-31-april-6/

A complete overview of all previous editions of Best of the Web can be found herehttp://tinyurl.com/c8ge4c5. All links provided are collected from public websites, unless otherwise specified. I have not checked the data or information for accuracy used, and therefore do not guarantee that all data provided will be 100% correct. The links provided do not necessarily reflect my personal opinion and should be seen as general interest: oftentimes I do not agree with arguments presented, but nevertheless think it is worthwhile to read them. It is up to the reader to make up their own mind. Suggestions or discussions are more than welcome. Do not quote unless specifically cleared beforehand!