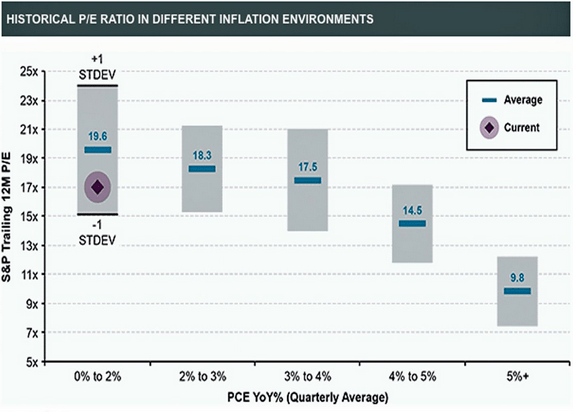

Good morning. This is certainly worth taking into account: stocks have been cheaper in de past, but mostly in high inflation rate environments…

http://www.businessinsider.com/pe-ratio-different-inflation-environments-2014-2

Interesting bit on momentum investing, “it gains recognition as the premier market anomaly” Oh?

http://climateerinvest.blogspot.nl/2014/02/momentum-as-only-reliable-market-anomaly.html

…which complements nicely with this read: “Is Behavioral Economics the Past or the Future?“

http://orderstatistic.wordpress.com/2014/02/28/is-behavioral-economics-the-past-or-the-future/

Part of the Economic Freedom Map is the ‘Monetary Freedom’. Don’t know what that means, but apparently the Germans are more free than the rest of Europe (minus Ireland..) (via @gercopauw)

http://www.heritage.org/index/heatmap#.Uw9ruvqZ-m0.twitter

Not exactly new, but certainly insightful: where did the money flow to? (via jan Sytze Mosselaar)

Yes, the US federal deficit has declined, but mostly because of higher revenue!

Cash is King!

http://ycharts.com/analysis/story/five_tech_stocks_400_billion_cash

All you always wanted to know about derivatives in a flashy looking website…

http://futuresfundamentals.cmegroup.com/index.html

Speaks for itself.

www.ritholtz.com/blog/2014/02/buffett-indicator-worthless/

The WallStreet Journal has made a infographic on social media and investing

http://online.wsj.com/public/resources/documents/BrunswickInvestorSurveyInfographic.pdf

A complete overview of all previous editions of Best of the Web can be found herehttp://tinyurl.com/c8ge4c5. All links provided are collected from public websites, unless otherwise specified. I have not checked the data or information for accuracy used, and therefore do not guarantee that all data provided will be 100% correct. The links provided do not necessarily reflect my personal opinion and should be seen as general interest: oftentimes I do not agree with arguments presented, but nevertheless think it is worthwhile to read them. It is up to the reader to make up their own mind. Suggestions or discussions are more than welcome. Do not quote unless specifically cleared beforehand!