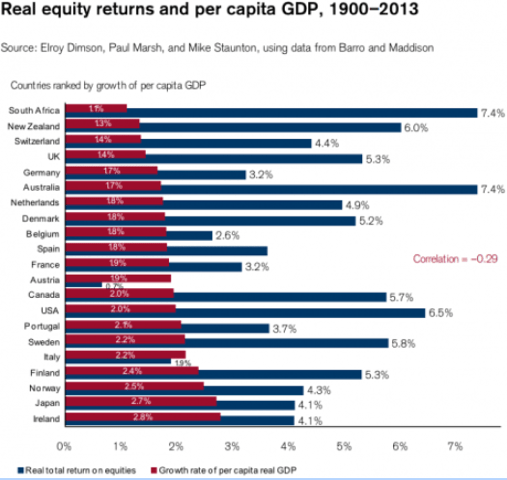

Good morning. Ah! Dimson, Marsh and Staunton are back with their annual overview of the stock markets!

http://www.businessinsider.com/equity-returns-and-gdp-per-capita-2014-2

…and here is some more from those guys

http://www.businessinsider.com/the-growth-paradox-past-economic-growth-does-not-predict-future-stockmarket-returns-2014-2

Best of last week. Comes with compliments.

https://lukasdaalder.com/2014/02/16/best-in-economics-this-week-february-14/

Fama explaining about efficient Markets Hypothesis. I haven’t watched it yet, though… (via http://johnhcochrane.blogspot.in/2014/02/a-brief-history-of-efficient-markets.html)

Still, 4% has picked inflation…

http://www.businessinsider.com/what-goldman-clients-are-worried-about-2014-2

Buy Greece and sell Japan. And than wait until 2030…

http://www.zerohedge.com/news/2014-02-14/chart-really-has-fed-worried

“Why good corporate earnings may be bad news”

http://www.ft.com/intl/cms/s/0/b3a9d6b2-95a3-11e3-8371-00144feab7de.html

Ok, I see the rise. But with an economy growing by on average by 8%, you would expect so, right?

http://www.zerohedge.com/news/2014-02-15/chinas-liquidity-bubble-hits-record-china-banks-issue-50-more-loans-fed-and-boj-qe-c

Mortgage backed bonds: a dying breed?

http://www.creditwritedowns.com/2014/02/the-shrinking-mbs-market.html

QE by the ECB. Sounds like a bridge too far, but credit suisse is taking it seriously…

http://ftalphaville.ft.com/2014/02/14/1772852/the-e1000000000000-question/

Interesting chart on the development of Energy intensity in the US…

http://www.calculatedriskblog.com/2014/02/energy-expenditures-as-percentage-of.html

Flappy bird has even made it to The Economist!

http://www.economist.com/blogs/graphicdetail/2014/02/value-flappy-bird

And the schedule for the week to come…

http://www.calculatedriskblog.com/2014/02/schedule-for-week-of-feb-16th.html

A complete overview of all previous editions of Best of the Web can be found herehttp://tinyurl.com/c8ge4c5. All links provided are collected from public websites, unless otherwise specified. I have not checked the data or information for accuracy used, and therefore do not guarantee that all data provided will be 100% correct. The links provided do not necessarily reflect my personal opinion and should be seen as general interest: oftentimes I do not agree with arguments presented, but nevertheless think it is worthwhile to read them. It is up to the reader to make up their own mind. Suggestions or discussions are more than welcome. Do not quote unless specifically cleared beforehand!