Good morning. So much for retail investors being the dumb money…

http://qz.com/176707/emerging-market-stocks-are-so-ugly-they-might-just-be-beautiful/

“Six China shadow banks threatened with default over coal firm exposure: paper”

http://www.reuters.com/article/2014/02/14/us-china-trust-default-idUSBREA1D06420140214

New research by the IMF: there is no magical debt level after which growth drops of. Government debt, that is…

http://www.imf.org/external/pubs/ft/wp/2014/wp1434.pdf

Interesting overview, even though I doubt that let’s say dropbox has done much innovation lately: ‘the world’s most innovative companies’

http://www.fastcompany.com/most-innovative-companies/2014/xiaomi

Fair point: something has to give here

http://www.businessinsider.com/retail-jobs-going-up-sales-going-down-2014-2

Nice chart. Not sure what the link with inflation is though (via @jackneele)

https://twitter.com/jackneele/status/433709039424245761

Predictable, but still interesting: job growth comes from young firms

http://www.zerohedge.com/news/2014-02-13/chart-day-where-do-jobs-come-and-where-do-they-go-die

Interesting data from the ECB on corporate leverage in the various Eurozone countries

http://www.ecb.europa.eu/pub/pdf/mobu/mb201402en.pdf

Ok, on the 13th of February you really want to know which asset class has done best, right?

http://www.businessinsider.com/year-to-date-asset-class-performance-2014-2

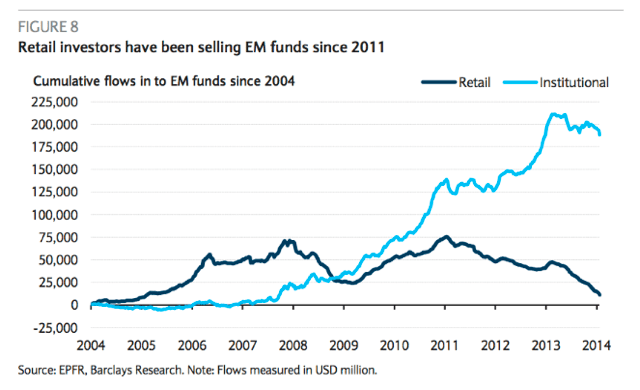

Morningstar’s opinion on whether or not emerging markets are cheap (via http://www.iexprofs.nl/Column/Opinie/116194/Zijn-opkomende-markten-goedkoop.aspx)

http://news.morningstar.com/articlenet/article.aspx?id=634648

A complete overview of all previous editions of Best of the Web can be found herehttp://tinyurl.com/c8ge4c5. All links provided are collected from public websites, unless otherwise specified. I have not checked the data or information for accuracy used, and therefore do not guarantee that all data provided will be 100% correct. The links provided do not necessarily reflect my personal opinion and should be seen as general interest: oftentimes I do not agree with arguments presented, but nevertheless think it is worthwhile to read them. It is up to the reader to make up their own mind. Suggestions or discussions are more than welcome. Do not quote unless specifically cleared beforehand!