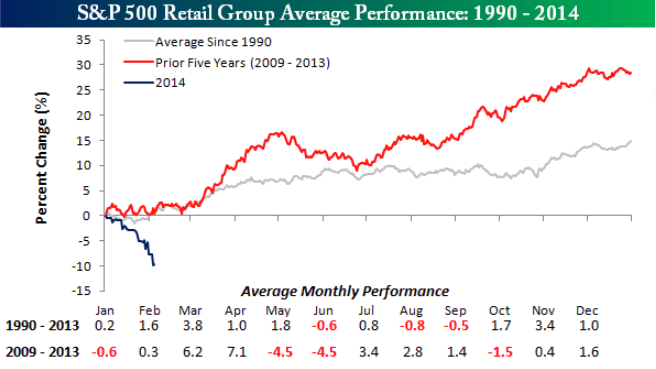

Good morning.The US retail sector is sort of the Nikkei of US sectors…

http://www.bespokeinvest.com/thinkbig/2014/2/4/a-rough-start-for-retail.html

Interesting piece by the Fed on the use and misuse of the employment-population ratio

http://libertystreeteconomics.newyorkfed.org/2014/02/a-mis-leading-labor-market-indicator.html

Some more on UK vs US, labour productivity and robotics by Martin Wolf…

http://www.ft.com/intl/cms/s/0/e1046e2e-8aae-11e3-9465-00144feab7de.html

…and here is a podcast by one of the authors of the book mentioned by Wolf

http://www.econtalk.org/archives/2014/02/brynjolfsson_on.html

CBO expects US budget to drop below 3%: finally they can join the euro!

http://www.businessinsider.com/cbo-deficit-report-2014-2

And from the same source comes this one. Probably needs some explanation…

http://www.ritholtz.com/blog/2014/02/why-dosnt-u-s-take-advantage-of-low-rates/

S&P500 ≠ Nominal GDP

http://www.businessinsider.com/sp-revenues-vs-nominal-gdp-2014-2

A complete overview of all previous editions of Best of the Web can be found herehttp://tinyurl.com/c8ge4c5. All links provided are collected from public websites, unless otherwise specified. I have not checked the data or information for accuracy used, and therefore do not guarantee that all data provided will be 100% correct. The links provided do not necessarily reflect my personal opinion and should be seen as general interest: oftentimes I do not agree with arguments presented, but nevertheless think it is worthwhile to read them. It is up to the reader to make up their own mind. Suggestions or discussions are more than welcome. Do not quote unless specifically cleared beforehand!