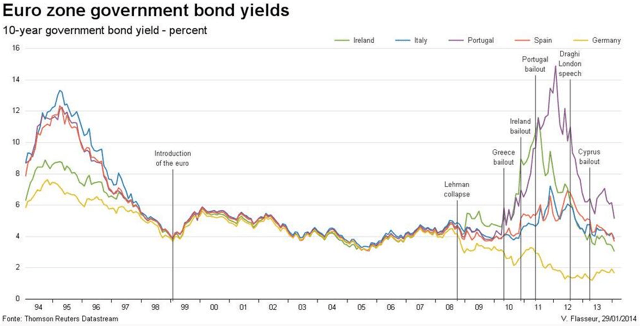

Good Morning. By special request on the top of the heap (via @ArendJanKamp): The euro-crisis

https://twitter.com/fmirw/status/428651548508291074

Cool overview of the performance of the various Fed Chairs on certain variables…

http://qz.com/171618/the-bernanke-era-isnt-over-not-by-a-long-shot/

“Do High Interest Rates Defend Currencies During Speculative Attacks?”Some empirical research on the matter

http://marginalrevolution.com/marginalrevolution/2014/01/do-high-interest-rates-defend-currencies-during-speculative-attacks.html

Not that anyone is interested at the moment, but hey: here is a cool country report on Peru by the IMF!

http://www.imf.org/external/pubs/ft/scr/2014/cr1422.pdf

Interesting overview of sector performance in the US since the taper announcement

http://www.bespokeinvest.com/thinkbig/2014/1/29/group-performance-since-the-taper.html

And did you lot notice that bitcoin is no less volatile than -say- the Turkish lira?

www.businessinsider.com/bitcoin-volatility-slows-2014-1

Nice charts on the performance of the S&P, both nominal…

…and real…

http://www.zerohedge.com/news/2014-01-29/where-does-market-rally-rank

On wage growth in the US (or the lack thereof)

http://www.washingtonpost.com/blogs/wonkblog/wp/2014/01/29/obama-is-asking-businesses-to-raise-wages-heres-why-they-likely-wont-listen/

A complete overview of all previous editions of Best of the Web can be found herehttp://tinyurl.com/c8ge4c5. All links provided are collected from public websites, unless otherwise specified. I have not checked the data or information for accuracy used, and therefore do not guarantee that all data provided will be 100% correct. The links provided do not necessarily reflect my personal opinion and should be seen as general interest: oftentimes I do not agree with arguments presented, but nevertheless think it is worthwhile to read them. It is up to the reader to make up their own mind. Suggestions or discussions are more than welcome. Do not quote unless specifically cleared beforehand!