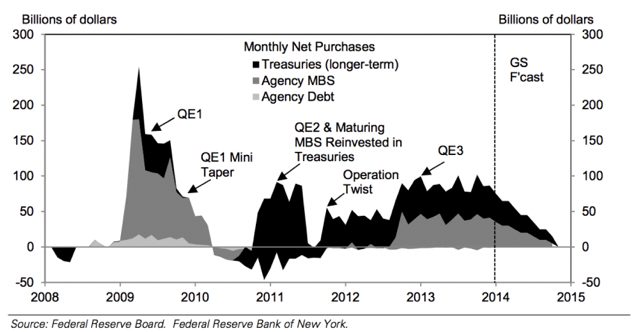

Good Morning. The history of QE as we know it…

http://www.businessinsider.com/quantitative-easing-chart-2014-1

The best of last week. If you don’t believe me, check it out yourself!

https://lukasdaalder.com/2014/01/26/best-in-economics-this-week-january-25/

A big sell-off! Although 2% used to be considered like small fries…

http://online.wsj.com/news/articles/SB10001424052702303448204579340480156732234

Big sell-off! But, apparently, it is nothing out of the ordinary…

http://www.bespokeinvest.com/thinkbig/2014/1/24/still-a-textbook-start-to-2014.html

So, what’s this sell-off all about? “Investors Flee Developing Countries”

http://online.wsj.com/news/articles/SB10001424052702303448204579338803161592252

“European banks have 84 billion euro capital shortfall, OECD estimates”

http://www.reuters.com/article/2014/01/25/us-banks-oecd-idUSBREA0O0GA20140125

http://www.wiwo.de/unternehmen/banken/oecd-studie-europaeische-banken-um-84-milliarden-euro-unterkapitalisiert/9379840.html

“The Myth of Industrial Rebound”. So much for that renaissance… (via @went11955)

http://www.nytimes.com/2014/01/26/opinion/sunday/rattner-the-myth-of-industrial-rebound.html

Interesting chart. Looks like China has been growing beyond its means…

http://www.bondvigilantes.com/blog/2014/01/24/chinas-investmentgdp-ratio-soars-to-a-totally-unsustainable-54-4-be-afraid/

Old data, but interesting nevertheless” pension fund portfolio allocatiosn

http://www.businessinsider.com/global-pension-fund-asset-allocations-2014-1

Nicely done, although I find it hard to believe that Jazz was that big in the 50s… (via http://www.ritholtz.com)

http://research.google.com/bigpicture/music/#

And the schedules for the week to come…

http://www.calculatedriskblog.com/2014/01/schedule-for-week-of-january-26th.html

http://blogs.ft.com/beyond-brics/2014/01/26/the-week-ahead-jan-27-31/

A complete overview of all previous editions of Best of the Web can be found herehttp://tinyurl.com/c8ge4c5. All links provided are collected from public websites, unless otherwise specified. I have not checked the data or information for accuracy used, and therefore do not guarantee that all data provided will be 100% correct. The links provided do not necessarily reflect my personal opinion and should be seen as general interest: oftentimes I do not agree with arguments presented, but nevertheless think it is worthwhile to read them. It is up to the reader to make up their own mind. Suggestions or discussions are more than welcome. Do not quote unless specifically cleared beforehand!