For all you rating-agency nerds out there: there are new EU rules for rating agencies publishing sovereign credit ratings on European countries (or, to be more specific, rating changes made by analysts based in Europe)… There probably is an official document available on the EU website, but as this is known as the-website-of-death, I dare not go there to look it up. Some brave soul from Reuters has done that for us, giving the main points here. Those main points are:

- No rating decision are allowed outside the strict calendar set, unless ‘in extreme cases’. I am thinking in the lines of a profit warning by a sovereign as an extreme case, but if someone knows the exact definition, let me know.

- Ratings have to be published on a Friday either an hour before or after market hours. I assume that would be European trading.

- We should not call it a downgrade diary. No. Nope. Not good.

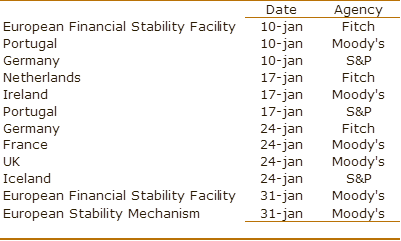

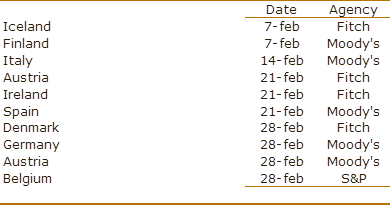

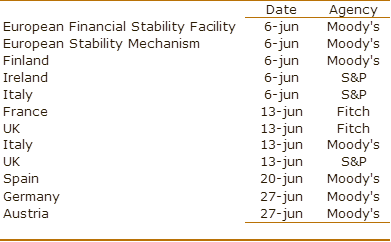

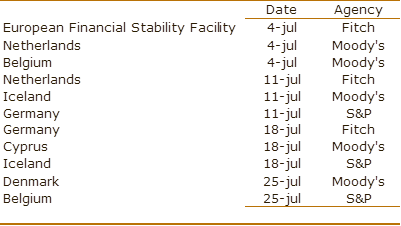

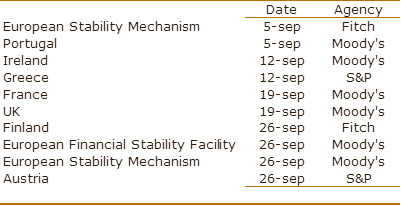

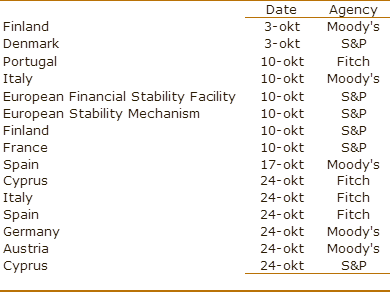

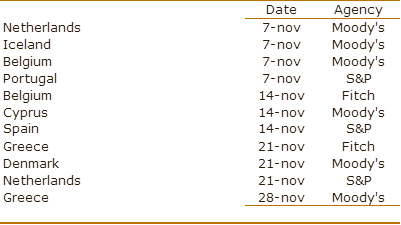

As for the calendar, with the help of a colleague from our fixed income department, I have constructed the overview for the more influential European countries. As far as the term ‘influential’ applies at all, as I cannot recall a single negative market response to a downgrade over the past two years.

Here you go: enjoy!

January

February

March

April

May

June

July

August

September

October

November

December

Of course, I do not take responsibility for any of the rating agencies updating or changing their publication schedule!