Good Morning. Ahhh. The time of looking forward to the year ahead has now seriously started…

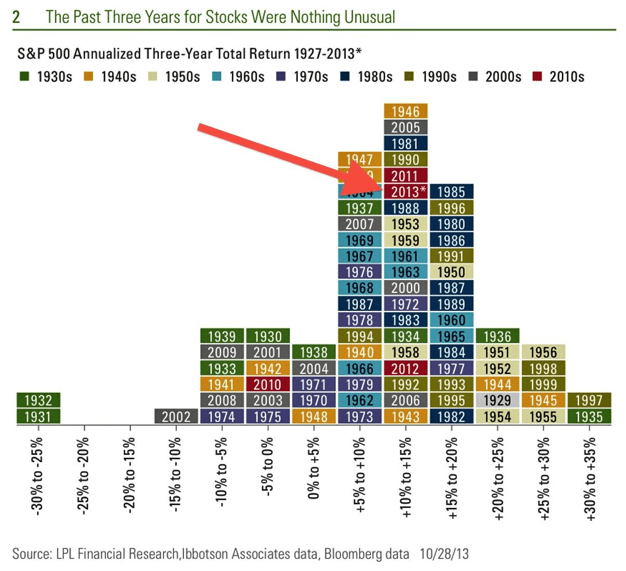

http://www.businessinsider.com/why-the-stock-market-wont-crash-2013-11#stocks-have-delivered-very-typical-3-year-average-returns-1

If you think that t-shirts are a low-tech product, mainly made in developing markets, listen to this podcast: you are in for a surprise…

http://www.npr.org/player/v2/mediaPlayer.html?action=2&t=1&islist=false&id=245470814&m=245526167

http://n.pr/HQR9M3

An interesting effort to turn a random cloud of data points into some sort of order with the help of colours

http://www.businessinsider.com/qe-correlations-between-stocks-and-bonds-2013-11

Sustainable investing according to RobecoSam. I can only applaud this.

http://www.youtube.com/watch?v=qQIgvRX9Apc

Friday’s making a late year dash for the title of Best Day to be Long this market!

http://www.bespokeinvest.com/thinkbig/2013/11/19/the-markets-case-of-the-mondays.html

Moody’s on the US high yield bond market: “Bond Covenant Quality Continues Steady Erosion”

And while we are on the subject of corporate bonds: this is the time structure of outstanding debt…

http://qz.com/148865/beware-the-looming-corporate-debt-cliff/

Interesting chart from the OECD outlook on the world’s sensitivity to non-OECD domestic demand. Not clear why China was not added to the test though…

http://www.keepeek.com/Digital-Asset-Management/oecd/economics/oecd-economic-outlook-volume-2013-issue-2_eco_outlook-v2013-2-en#page25

To state that investments in Asia are still ‘low’ (28% of GDP) following the 1997 collapse seems a bit strange…

A nice overview of time (of which this is only a small part, so click on the link to get the total)

http://www.waitbutwhy.com/2013/08/putting-time-in-perspective.html

A complete overview of all previous editions of Best of the Web can be found herehttp://tinyurl.com/c8ge4c5. All links provided are collected from public websites, unless otherwise specified. I have not checked the data or information for accuracy used, and therefore do not guarantee that all data provided will be 100% correct. The links provided do not necessarily reflect my personal opinion and should be seen as general interest: oftentimes I do not agree with arguments presented, but nevertheless think it is worthwhile to read them. It is up to the reader to make up their own mind. Suggestions or discussions are more than welcome. Do not quote unless specifically cleared beforehand!