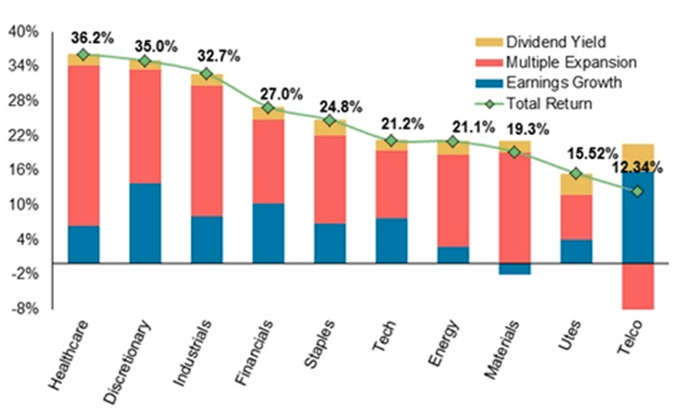

Good Morning. Cool chart from the analysts from Morgan Stanley showing which sector has risen the most in PE terms…

source: MorganStanley

…and this is the same for the S&P since 1960

http://www.businessinsider.com/stock-market-returns-decomposed-2013-11

The year isn’t over yet, but so far, equities are king….

http://www.businessinsider.com/stocks-outperformed-bonds-in-2013-2013-11

…which raises the question if stock markets are in a bubble. Robert Shiller thinks not (yet)…

http://online.wsj.com/news/articles/SB10001424052702303559504579197830356373734

…but if you read this GMO investment outlook, you will not be too thrilled by its 7 year outlook for stocks…

http://www.zerohedge.com/sites/default/files/images/user5/imageroot/2013/11/Grantham%20Letter%20Nov%2018%20-%20Overvalued%20Stocks.pdf

Is the fed behind the curve? (as asked by @Pawelmorski)

I have mentioned the report last week, but not sufficiently so: McKinsey takes a crack at the costs and benefits of QE… (via @MPNAdeBoer)

Is this a problem of productivity, or just simply the problem of measuring it?

http://www.businessinsider.com/credit-suisse-potential-growth-slowing-2013-11

A complete overview of all previous editions of Best of the Web can be found herehttp://tinyurl.com/c8ge4c5. All links provided are collected from public websites, unless otherwise specified. I have not checked the data or information for accuracy used, and therefore do not guarantee that all data provided will be 100% correct. The links provided do not necessarily reflect my personal opinion and should be seen as general interest: oftentimes I do not agree with arguments presented, but nevertheless think it is worthwhile to read them. It is up to the reader to make up their own mind. Suggestions or discussions are more than welcome. Do not quote unless specifically cleared beforehand!