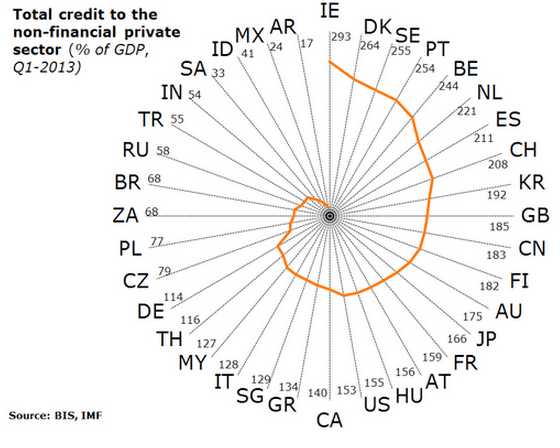

Good Morning. Debt. But we seldom get to see the other side of the coin: someone owns the debt. Wealth. (via @Johan3704)

https://twitter.com/shahinkamalodin/status/397411380824780800/photo/1

A presentation by a Fed board member on the topic of tapering: you better listen!

http://research.stlouisfed.org/econ/bullard/pdf/BullardStLRegChamberFinancialForum1November2013Final.pdf

Non performing loans in Europe: The Netherlands looks pretty healthy here… Surprisingly so

http://ftalphaville.ft.com/2013/11/05/1686722/the-npl-standardisation-factor/

Cool chart, which seems to imply that the myth of of no-investment is overdone. As long as you agree that acquisitions are grotwh related, that is…

http://www.businessinsider.com/sp-500-cash-usage-2013-11

Interesting question: will (US) pension funds reduce risk once they are fully funded again, or will they increase risk…?

http://www.businessinsider.com/pension-funds-funded-status-2013-11

Some more information on the (high) Shiller PE…

http://www.businessinsider.com/robert-shiller-explains-how-to-use-cape-2013-11

…and talking about Shiller PE’s: Europe is the cheapest!

http://blogs.ft.com/beyond-brics/2013/11/05/em-stock-cheap-or-just-riskier/

Deleveraging European banks: yesterday’s news: when will they start to relever again?

http://www.businessinsider.com/european-bank-deleveraging-2013-11

Numerous (non-)essential international comparisons between countries by the OECD. On lazy Italian men…

http://qz.com/143730/italian-men-dont-like-housework-canada-has-too-many-rooms-and-eight-other-data-updates-on-the-world/

Wow! Cool charts at the end of 50 pages of research by the IMF on the potential GDP loss in the US

http://www.imf.org/external/np/res/seminars/2013/arc/pdf/wilcox.pdf

A complete overview of all previous editions of Best of the Web can be found herehttp://tinyurl.com/c8ge4c5. All links provided are collected from public websites, unless otherwise specified. I have not checked the data or information for accuracy used, and therefore do not guarantee that all data provided will be 100% correct. The links provided do not necessarily reflect my personal opinion and should be seen as general interest: oftentimes I do not agree with arguments presented, but nevertheless think it is worthwhile to read them. It is up to the reader to make up their own mind. Suggestions or discussions are more than welcome. Do not quote unless specifically cleared beforehand!