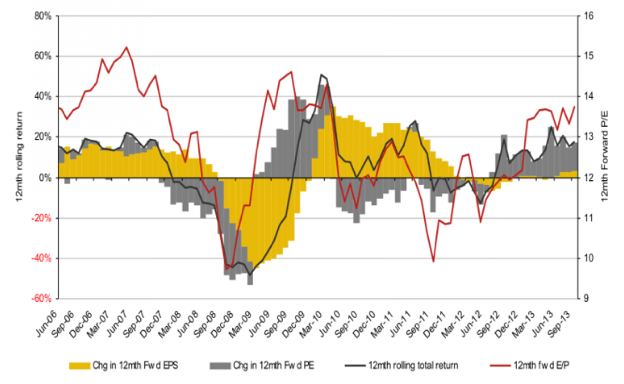

Good Morning. Earnings growth has been near absent: stock gains have been all about stocks getting more expensive

Interesting way of presenting the growth of China: by showing the relative decline of the rest

http://www.zerohedge.com/news/2013-10-10/incredible-shrinking-world-relative-china

Study by the Dutch Central Bank into the depressed level of consumer confidence and how that is linked to ‘Trust’: the coverage ratio of pensions rule!

http://www.dnb.nl/binaries/Working%20Paper%20394_tcm46-296775.pdf

The Fed Dove-Hawk scale….

http://www.zerohedge.com/news/2013-10-10/look-feds-nest-2014-here-are-next-years-voting-hawks-and-doves

How to lie with statistics: comparing these two charts ignores the fact that Russia is poorer overall… This is Russia…

…and this the US….

http://www.businessinsider.com/putting-russias-unparalleled-wealth-disparity-in-perspective-2013-10

Another nice one: US oil independency is on the rise

This sort of questions how strong the European growth rebound is going to be…

http://qz.com/134227/euro-zone-banks-may-need-another-fix-of-emergency-funds-will-the-ecb-oblige/

What happened to The Netherlands…? We are the top three in this chart, easily!

http://www.bondvigilantes.com/blog/2013/10/10/italy-the-good-the-bad-and-the-politicians/

And The Economist has a special report on the World Economy…

A complete overview of all previous editions of Best of the Web can be found herehttp://tinyurl.com/c8ge4c5. All links provided are collected from public websites, unless otherwise specified. I have not checked the data or information for accuracy used, and therefore do not guarantee that all data provided will be 100% correct. The links provided do not necessarily reflect my personal opinion and should be seen as general interest: oftentimes I do not agree with arguments presented, but nevertheless think it is worthwhile to read them. It is up to the reader to make up their own mind. Suggestions or discussions are more than welcome. Do not quote unless specifically cleared beforehand!