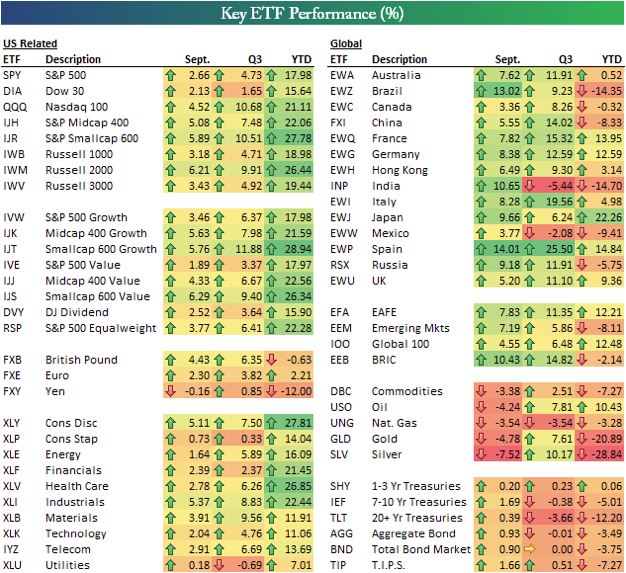

Good morning. September was nowhere near as gruesome as feared….

http://www.bespokeinvest.com/thinkbig/2013/10/1/september-q3-and-ytd-asset-class-performance.html

The IMF has something to say on debt reduction – the hard way

http://blog-imfdirect.imf.org/2013/09/25/taming-government-debt-it-can-be-done-but-it-aint-easy/

Nice, glossy report by Shell on the future of… a lot of things, really

http://s01.static-shell.com/content/dam/shell-new/local/corporate/Scenarios/Downloads/Scenarios_newdoc.pdf

A number of interesting charts on the deteriorating fundamentals of the credit market

http://www.zerohedge.com/news/2013-10-01/carl-icahns-nightmare-or-credit-bubble-4-simple-charts

GROWTH!! (but the risk is that the payroll report will not be published on Friday)

http://www.bespokeinvest.com/thinkbig/2013/10/1/ism-manufacturing-hits-highest-level-since-april-2011.html

Right. The Fed on the success of forward guidance. The analyses runs conveniently until 2012 though…

www.frbsf.org/economic-research/publications/economic-letter/2013/september/zero-lower-bound-interest-rates-long-term-yields/

The end at the light of the tunnel, or a bouncing cat, with little live in it…?

http://blogs.ft.com/beyond-brics/2013/10/01/em-bonds-a-record-september/

Golden years….

http://www.economist.com/blogs/graphicdetail/2013/10/daily-chart

A technical analysis chart: I haven’t had one of those in ages. This one is negative: correction is coming

http://www.zerohedge.com/news/2013-10-01/4-bearish-divergences-different-time-believers

A complete overview of all previous editions of Best of the Web can be found herehttp://tinyurl.com/c8ge4c5. All links provided are collected from public websites, unless otherwise specified. I have not checked the data or information for accuracy used, and therefore do not guarantee that all data provided will be 100% correct. The links provided do not necessarily reflect my personal opinion and should be seen as general interest: oftentimes I do not agree with arguments presented, but nevertheless think it is worthwhile to read them. It is up to the reader to make up their own mind. Suggestions or discussions are more than welcome. Do not quote unless specifically cleared beforehand!