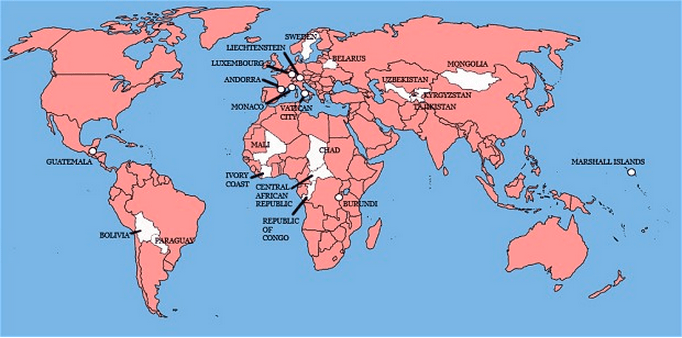

Good morning. I didn’t check the definition of ‘invasion’ but apparently UK has done a lot of it, over the years…

I’ll start off with stocks, while bonds are omnipresent these days: gone is the high correlation within stocks!

http://online.wsj.com/article/SB10001424127887323423804579020743528021238.html

Nice overview of all the bond market bear markets in the past… Mind you, US and 30 years…

http://www.bespokeinvest.com/thinkbig/2013/8/19/bond-market-bear-markets.html

…which is a slightly different picture from this one, which shows that the correction in US 10 year yields is pretty extreme…

http://ftalphaville.ft.com/2013/08/19/1606563/that-spike-in-us-treasury-yields/

…which makes Deutsche Bank think that the correction is done. That, or something worse…

http://www.zerohedge.com/news/2013-08-19/deutsche-either-central-banks-lose-credibility-soon-or-markets-have-overstretched-th

…but there is some good news too!

http://online.wsj.com/article/SB10001424127887324085304579010101464289162.html

…while Germany has saved a lot on interest costs due to the low interest rate enviromnent

http://www.spiegel.de/international/europe/germany-profiting-from-euro-crisis-through-low-interest-rates-a-917296.html

So far, Abenomics has not resulted in a marked improvement in the trade balance…

http://www.businessinsider.com/this-chart-debunks-the-biggest-myth-about-abenomics-2013-8

The outflow of Emerging MArkets has continued…

http://qz.com/116628/investors-in-emerging-markets-would-like-their-money-back-now-thanks/

A complete overview of all previous editions of Best of the Web can be found herehttp://tinyurl.com/c8ge4c5. All links provided are collected from public websites, unless otherwise specified. I have not checked the data or information for accuracy used, and therefore do not guarantee that all data provided will be 100% correct. The links provided do not necessarily reflect my personal opinion and should be seen as general interest: oftentimes I do not agree with arguments presented, but nevertheless think it is worthwhile to read them. It is up to the reader to make up their own mind. Suggestions or discussions are more than welcome. Do not quote unless specifically cleared beforehand!