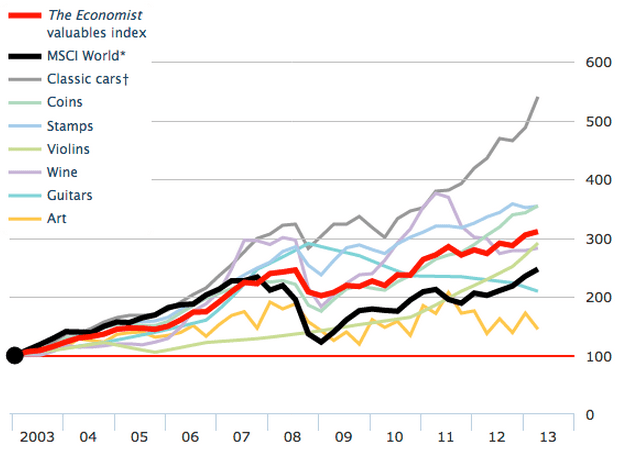

Good morning. Nice overview from The Economist on various ‘asset classes’

http://www.economist.com/news/finance-and-economics/21583662-investing-luxury-items-can-yield-high-returns-risks-are-commensurate-fruits

Forget about yesterday’s sell-off in stocks: Shangai is (mysteriously) surging! It has been up +5.7% earlier today

http://www.forexlive.com/blog/2013/08/16/shanghai-composite-fat-finger-maybe-not-still-surging/

A colourful update on US debt and its components

http://www.ritholtz.com/blog/2013/08/the-deleveraging-american-consumer/

Final outcome of the second quarter earnings reports: Earnings were stronger than expected…

…while even revenues on average came in better than expected

http://www.bespokeinvest.com/thinkbig/2013/8/15/final-q2-13-earnings-and-revenue-beat-rates.html

And speaking of stocks: this is an interesting chart as it looks at total return and not just simply the price

http://www.rickferri.com/blog/markets/market-valuation-and-asset-allocation-decisions/

And as a reminder: the Shiller PE has risen to 23.8x trailing earnings…

http://blogs.ft.com/ft-long-short/2013/08/13/the-cape-of-less-hope/

Unbelievable video on a robot duplicating art..

http://vimeo.com/68859229

Demand for gold declined in Q2. Somehow I am not too surprised.

http://www.businessinsider.com/chart-of-the-day-gold-demand-2013-8

A complete overview of all previous editions of Best of the Web can be found herehttp://tinyurl.com/c8ge4c5. All links provided are collected from public websites, unless otherwise specified. I have not checked the data or information for accuracy used, and therefore do not guarantee that all data provided will be 100% correct. The links provided do not necessarily reflect my personal opinion and should be seen as general interest: oftentimes I do not agree with arguments presented, but nevertheless think it is worthwhile to read them. It is up to the reader to make up their own mind. Suggestions or discussions are more than welcome. Do not quote unless specifically cleared beforehand!