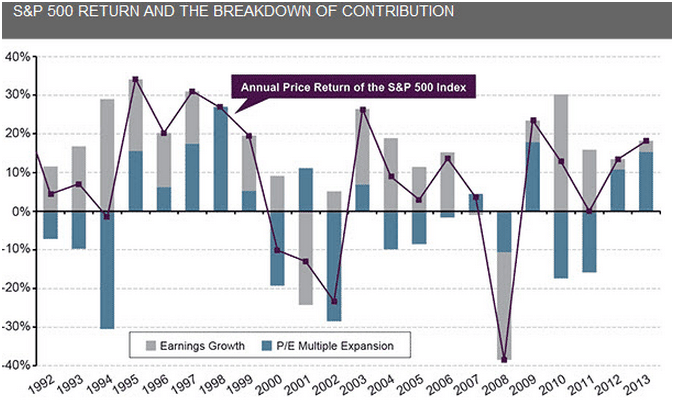

Good morning. So… How much higher can stocks go without earnings growth…?

Performance of some of the European economies from the start of the credit crisis…

http://www.businessinsider.com/european-gdp-since-pre-crisis-chart-2013-8

Bill Gross at the Somme, and a sharp reaction from alphaville

http://media.pimco.com/Documents/InvestmentOutlook_BondWars_1986.pdf

http://ftalphaville.ft.com/2013/08/08/1596532/no-bill-losing-money-on-bonds-is-not-like-dying-at-the-somme/?

Small update on the earnings season in the US

http://www.bespokeinvest.com/thinkbig/2013/8/8/sector-performance-on-earnings.html

This should be worth a read: a study by goldman sachs into ‘disruptive themes’ like 3D printing, alternative capital or LED lights…

http://www.zerohedge.com/news/2013-08-08/goldmans-top-disruptive-themes

Interesting chart showing the number of dividend cuts in the US. I am a bit surprised by the 2012-’13 spike, though…

Ok, so this is from a BIS conference held in january (old), but the topic is still current: “Sovereign risk: a world without risk-free assets?“

http://www.bis.org/publ/bppdf/bispap72.htm

Longest study yet into the momentum trading strategy. It works, but sometimes you have to wait very long for your excess return… (via @ronalddoeswijk)

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2292544

Some informative charts on private equity

http://www.businessinsider.com/pe-firms-are-raising-money-since-2009-2013-8

Not surprising and not very economic, but I thought it was worth sharing nevertheless…

http://online.wsj.com/article/SB10001424127887323997004578640531575133750.html

A complete overview of all previous editions of Best of the Web can be found herehttp://tinyurl.com/c8ge4c5. All links provided are collected from public websites, unless otherwise specified. I have not checked the data or information for accuracy used, and therefore do not guarantee that all data provided will be 100% correct. The links provided do not necessarily reflect my personal opinion and should be seen as general interest: oftentimes I do not agree with arguments presented, but nevertheless think it is worthwhile to read them. It is up to the reader to make up their own mind. Suggestions or discussions are more than welcome. Do not quote unless specifically cleared beforehand!