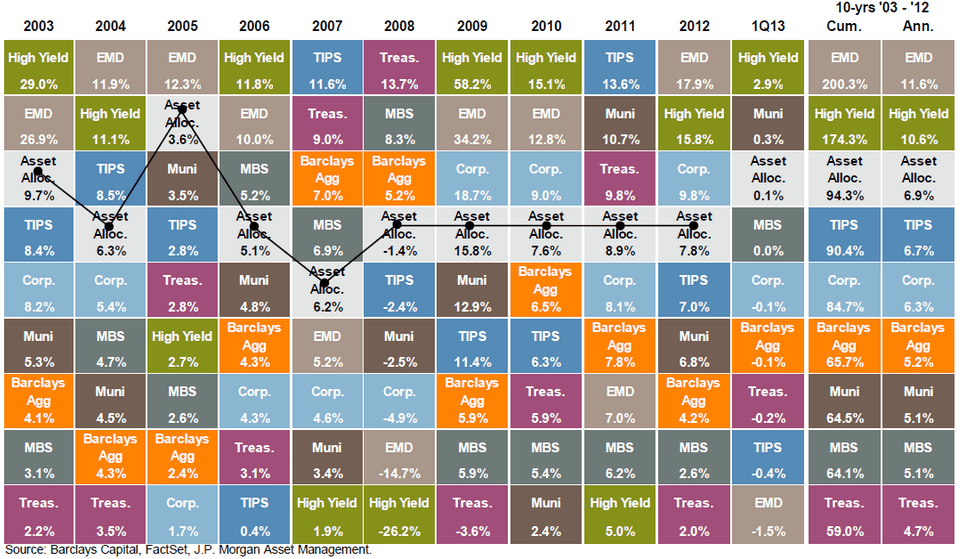

Good morning. I am not sure what the ‘asset allocation’ line is (I guess JP Morgan’s allocation), but it is a nice overview of the various bond returns over the years

http://www.ritholtz.com/blog/2013/06/looking-at-asset-class-returns-by-year/

And speaking of asset returns, here’s another chart:

http://www.businessinsider.com/asset-class-returns-since-november-2008-2013-6

Mark Thoma lists seven forms of market failure. Not all apply outside the US, but still

http://www.thefiscaltimes.com/Columns/2013/06/18/7-Important-Examples-of-How-Markets-Can-Fail.aspx

“Tokyo Shares Get a Second Look” From the WallStreet Journal

http://online.wsj.com/article/SB10001424127887323836504578551331459129980.html

More trouble brewing in China? Interbank rates have spiked (although they have done so in the past as well)

http://www.businessinsider.com/pboc-no-relief-amid-credit-crunch-2013-6

The credit quality of companies is steadily deteriorating, according to these charts…

http://www.zerohedge.com/news/2013-06-18/credit-cycle-over

…which brings us to this chart: corrections in High Yields. We have seen nothing out of the ordinary just yet

http://www.zerohedge.com/news/2013-06-18/what-correction-could-look

I continue to hear Nigeria popping up as the big up and coming economy…

http://www.economist.com/blogs/graphicdetail/2013/06/daily-chart-10

How to lie with charts: initial claims ‘closely mirror’ stocks. Except that the axis is somewhat off…

http://blogs.wsj.com/moneybeat/2013/06/18/the-rally-in-three-charts-hint-its-not-all-about-the-fed/

A complete overview of all previous editions of Best of the Web can be found herehttp://tinyurl.com/c8ge4c5.All links provided are collected from public websites, unless otherwise specified. I have not checked the data or information for accuracy used, and therefore do not guarantee that all data provided will be 100% correct. The links provided do not necessarily reflect my personal opinion and should be seen as general interest: oftentimes I do not agree with arguments presented, but nevertheless think it is worthwhile to read them. It is up to the reader to make up their own mind. Suggestions or discussions are more than welcome. Do not quote unless specifically cleared beforehand!