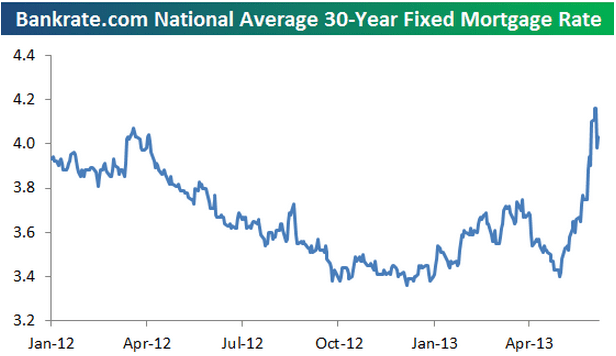

Good morning. Not that I think you have missed it, but did you guys see the move in the US mortgage rates….?

http://www.bespokeinvest.com/thinkbig/2013/6/11/more-on-the-spike-in-mortgage-rates.html

And did you know that inflation linked bonds have a positive yield again…?

http://www.crossingwallstreet.com/archives/2013/06/10-year-tips-yield-is-finally-positive.html

And did you see the outflow in bond funds last week…. Is this a bear market, perhaps…?

http://qz.com/93212/people-are-now-running-from-bonds-running/

Ah well, and while we are on the subject of bonds, this one is interesting as well: High Yield to Treasury correlation

http://soberlook.com/2013/06/high-yield-bonds-to-treasuries.html

Martin Wolf from the FT on overstated danger of inflation

http://www.ft.com/intl/cms/s/0/e779acb2-d1de-11e2-b17e-00144feab7de.html

The stock markets seem to move in tandem with the yen these days…. The longer term track-record is less impressive though

http://www.bespokeinvest.com/thinkbig/2013/6/11/sp-500-vs-japanese-yen.html

A number of charts on the European labour market…

http://www.economonitor.com/rebeccawilder/2013/06/10/unhealthy-developments-across-the-euro-area-labour-market/

The ongoing conflict in Syria put into perspective of Iraq 5 years ago…

http://www.economist.com/blogs/graphicdetail/2013/06/daily-chart-4

A complete overview of all previous editions of Best of the Web can be found here http://tinyurl.com/c8ge4c5. All links provided are collected from public websites, unless otherwise specified. I have not checked the data or information for accuracy used, and therefore do not guarantee that all data provided will be 100% correct. The links provided do not necessarily reflect my personal opinion and should be seen as general interest: oftentimes I do not agree with arguments presented, but nevertheless think it is worthwhile to read them. It is up to the reader to make up their own mind. Suggestions or discussions are more than welcome. Do not quote unless specifically cleared beforehand!