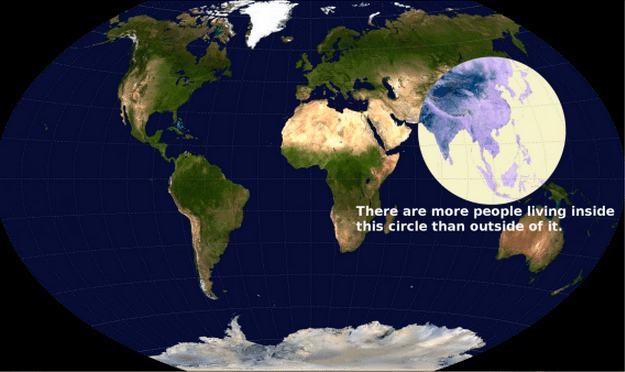

Good morning. Brilliant way to show where the party’s at! (via @went1955)

http://www.slate.com/blogs/moneybox/2013/05/07/asia_population_circle.html

This is old, but man, it is cool as well! 220 years of growth…

http://www.businessinsider.com/lacy-hunt-mauldin-presentation-2013-5

If you do not know what the Bakken is, that’s the North Dokota shale gas boom area… (via alphaville)

http://www.minneapolisfed.org/publications_papers/pub_display.cfm

Interesting chart on the past performance of the Nikkei during solid strats of the year.

http://www.bespokeinvest.com/thinkbig/2013/5/7/land-of-the-rising-stock-market.html

The length between US recessions appears to show that wars and rising debt can work wonders (at least for some time)

http://www.zerohedge.com/news/2013-05-07/guest-post-debunking-keynesian-policy-framework-myth-magic-pendulum

“NYSE margin debt raises eyebrows” Thought you lot should know as well…

http://blogs.wsj.com/moneybeat/2013/05/06/nyse-margin-debt-raises-eyebrows/

US Senior Loan Officers’ survey shows that the US banking sector is recovering further

http://www.federalreserve.gov/boarddocs/snloansurvey/201305/fullreport.pdf

Remarkable seasonal pattern in the gasoline prices in the US. It is only partly linked to the world oil markets…

http://www.bespokeinvest.com/thinkbig/2013/5/7/some-modest-relief-at-the-pump.html

Interesting thoughts on what a negative deposit rate could mean for Euro-area banks

http://ftalphaville.ft.com/2013/05/07/1488492/what-the-danish-negative-rate-experience-tells-us/

The regional economic outlook from the IMF on the Western Hemisphere

http://www.imf.org/external/pubs/ft/reo/2013/whd/eng/pdf/wreo0513.pdf

Here we go again: research into assets and liabilities from households. I vaguely recall a lot of controversy on an ECB study, last month…

http://www.bancaditalia.it/pubblicazioni/econo/quest_ecofin_2/qef160/QEF_160.pdf

There is nothing wrong wit a little bit of dating mining from time to time. Tuesdays are the days to be long. (this year… so far….)

http://www.zerohedge.com/news/2013-05-07/your-sp-your-sp-without-tuesdays

And to top it off, three charts on buying and selling among certain investor groups: hedge funds…

…institutional companies…

…and private clients. With most of them selling, why do stocks move higher?

http://www.businessinsider.com/bofa-clients-selling-rally-for-weeks-2013-5

A complete overview of all previous editions of Best of the Web can be found here http://tinyurl.com/c8ge4c5. All links provided are collected from public websites, unless otherwise specified. I have not checked the data or information for accuracy used, and therefore do not guarantee that all data provided will be 100% correct. The links provided do not necessarily reflect my personal opinion and should be seen as general interest: oftentimes I do not agree with arguments presented, but nevertheless think it is worthwhile to read them. It is up to the reader to make up their own mind. Suggestions or discussions are more than welcome. Do not quote unless specifically cleared beforehand!