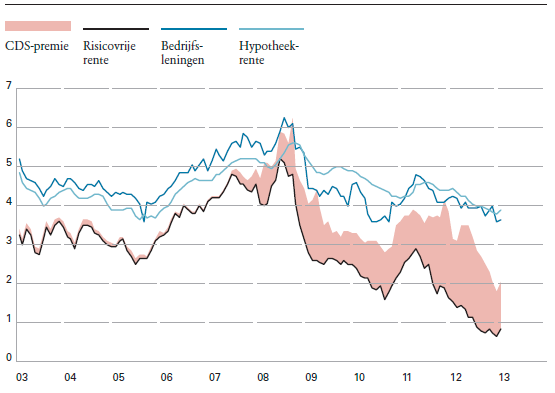

Good morning. In Dutch, but easy to understand: the gap between risk free rate (dark line) and interest rates charged on mortgages and companies (blue lines). In other words: lowering interest rates does little for the economy

http://www.dnb.nl/binaries/OFS_Voorjaar13_tcm46-289597.pdf

Interesting read on capital requirements for banks

http://economix.blogs.nytimes.com/2013/04/18/the-impact-of-higher-capital-requirements-for-banks/

Bonds Rule! Well, at least they did over the past three years…

http://www.bondvigilantes.com/blog/2013/04/18/2020-hindsight-looking-at-three-year-government-bond-market-returns/

Stocks Rule! Well, as long as the Bull Market continues, of course… 🙂

http://gestaltu.blogspot.nl/2013/04/what-bull-giveth-bear-taketh-away.html

Emerging Markets Rule! Oh no, they don’t…

http://soberlook.com/2013/04/reasons-behind-emerging-markets.html

I published something like this about two months ago, but Barclays has made charts out of it: stocks hitting a new all-time high is not a sell signal, generally

http://www.zerohedge.com/news/2013-04-18/how-do-markets-perform-after-hitting-all-time-highs

Interesting chart showing the US sector performance this year so far….

http://www.bespokeinvest.com/thinkbig/2013/4/18/tech-slips-into-the-red.html

The lost continent is back. With a vengeance…?

http://www.economist.com/blogs/graphicdetail/2013/04/daily-chart-12

And Apple continues to trigger the fantasy. Here is how much market cap was lot in two days into perspective

http://www.zerohedge.com/news/2013-04-18/past-48-hours-aapl-has-lost-more-market-cap-all

“How might carmaking look 20 years from now?” Behind the paywall, but it is special report of The economist this week

http://www.economist.com/news/special-report/21576223-how-might-carmaking-look-20-years-now-road-2033

A complete overview of all previous editions of Best of the Web can be found here http://tinyurl.com/c8ge4c5. All links provided are collected from public websites, unless otherwise specified. I have not checked the data or information for accuracy used, and therefore do not guarantee that all data provided will be 100% correct. The links provided do not necessarily reflect my personal opinion and should be seen as general interest: oftentimes I do not agree with arguments presented, but nevertheless think it is worthwhile to read them. It is up to the reader to make up their own mind. Suggestions or discussions are more than welcome. Do not quote unless specifically cleared beforehand!

Waarom tellen ze de CDS-premie op bij de risk-free rate?

Om de fundingkosten van een bank beter weer te geven.