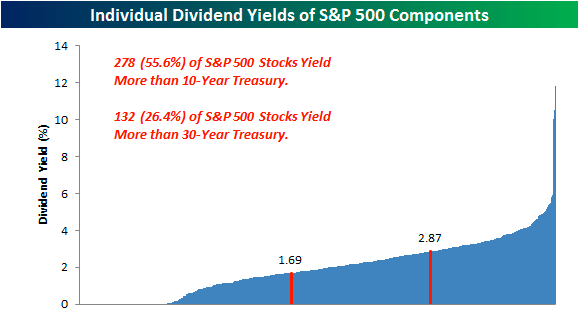

Good morning. Stocks may be expensive, but looking at this chart, bonds are even more expensive!

http://www.bespokeinvest.com/thinkbig/2013/4/17/54-of-sp-500-stocks-yield-more-than-the-10-yr-treasury.html

The estimated rise of shadow banking in China, updated…

http://ftalphaville.ft.com/2013/04/17/1463992/chinas-credit-to-gdp-ratio-updated-and-why-it-matters/

…while corporate debt is also pretty high. If you are to believe these numbers, of course

http://www.zerohedge.com/news/2013-04-17/overnight-sentiment-drifting-lower

And while we are on the subject of showing depressing charts: UK wage growth is heading lower (via @MerrynSW)…

http://ymlp.com/zlKbgX

…and the US seems to have a problem on their own…

http://www.zerohedge.com/news/2013-04-17/guest-post-more-evidence-economic-peak

Cool chart with the black line showing how fast the leverage ratio of failed banks moved from median to worrisome in the US. Interesting research by the Dallas Fed.

http://www.dallasfed.org/research/eclett/2013/el1302.cfm

Following last week’s turmoil in the commodity markets: what is the status of the various commodities?

http://www.bespokeinvest.com/thinkbig/2013/4/17/bespokes-commodity-snapshot.html

In case you missed it (which is pretty unlikely): this is the Reinhart Rogoff problem

http://www.economist.com/blogs/freeexchange/2013/04/debt-and-growth

Moore’s law does not only work for chips and research, but also proves ET’s existence. Or something like that.

http://www.technologyreview.com/view/513781/moores-law-and-the-origin-of-life/

Brilliant way of showing the differences in income in New York, using the subway. (via @UmpaNL)

http://www.newyorker.com/sandbox/business/subway.html

A complete overview of all previous editions of Best of the Web can be found here http://tinyurl.com/c8ge4c5. All links provided are collected from public websites, unless otherwise specified. I have not checked the data or information for accuracy used, and therefore do not guarantee that all data provided will be 100% correct. The links provided do not necessarily reflect my personal opinion and should be seen as general interest: oftentimes I do not agree with arguments presented, but nevertheless think it is worthwhile to read them. It is up to the reader to make up their own mind. Suggestions or discussions are more than welcome. Do not quote unless specifically cleared beforehand!