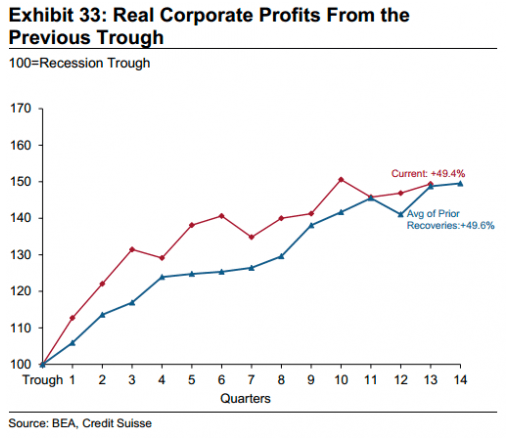

Good morning. Interesting fact: even though the recovery of the US economy has been weaker, this does not apply for earnings…

Cool chart showing the importance of the various components for total inflation in the US

Some uncertainty about the appointment of the new Bank of Japan governor and deputy governor

An NBER study on the long-term (1860) price development of real commodity prices

http://papers.nber.org/tmp/75061-w18874.pdf

http://www.economist.com/blogs/freeexchange/2013/03/resource-prices

And speaking of commodities, this continuing decline in industrial commodity prices, is that something we should be worried about? (or is the chart just old…)

Pretty clear who the big guys in the currency markets are (although I think Switzerland is underestimated)

http://www.zerohedge.com/news/2013-03-12/whos-got-all-cash-now

Spending on Food: the poorer the country, the bigger the expense (in relative terms)

http://www.economist.com/blogs/graphicdetail/2013/03/daily-chart-5

Pfff. Gold has a small pullback and all of a sudden it is called the worst performing asset in 2013…

http://qz.com/61896/gold-is-the-worst-investment-of-2013/

Remarkable difference between the life expectancy of two counties in the US…

A complete overview of all previous editions of Best of the Web can be found herehttp://tinyurl.com/c8ge4c5. All links provided are collected from public websites, unless otherwise specified. I have not checked the data or information for accuracy used, and therefore do not guarantee that all data provided will be 100% correct. The links provided do not necessarily reflect my personal opinion and should be seen as general interest: oftentimes I do not agree with arguments presented, but nevertheless think it is worthwhile to read them. It is up to the reader to make up their own mind. Suggestions or discussions are more than welcome. Do not quote unless specifically cleared beforehand!