Good morning. Cool chart. Remember that strong rally in the Nikkei? Not if you measure it in dollars (or euros for that matter)

http://www.zerohedge.com/news/2013-02-01/guess-how-much-japans-stock-market-rose-january

Nice chart showing the stock markets reaction to the earning results. Pretty positive, so far…

· http://www.bespokeinvest.com/thinkbig/2013/2/1/stocks-doing-well-on-earnings.html

More money has flowed into equity funds during the last week of January. But a rotation, it is not.

· http://www.businessinsider.com/fund-flow-data-for-final-week-in-january-2013-2

And this article sort of says the same: “Great Rotation”- A Wall Street fairy tale?

· http://www.reuters.com/article/2013/02/02/us-usa-stocks-weekahead-idUSBRE91101520130202

Oh, and in case you think it is positive, money flowing into equities: it is a sell signal according to Bank of America..

· http://www.zerohedge.com/news/2013-02-01/5-correction-sell-signal-triggered-just-january-2011

If this chart is supposed to show that we are close to a recession, it miserably fails. Interesting though that even in a recession revenue can grow

· http://www.zerohedge.com/news/2013-02-03/new-normal-nine-charts

Metals are just drifting along, by the looks of it…

· http://www.economist.com/news/economic-and-financial-indicators/21571161-metals

The Bill Gross’ monthly report is called Credit Supernova. Haven’t read it yet, but normally is worth the time

· http://www.pimco.com/EN/Insights/Pages/Credit-Supernova.aspx

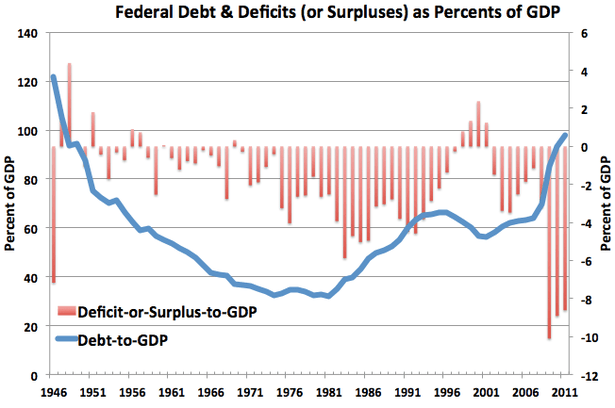

Why the U.S. Government Never, Ever Has to Pay Back All Its Debt. Because the government never dies.

And last, but not least, the schedules for the week ahead

· http://www.calculatedriskblog.com/2013/02/schedule-for-week-of-feb-3rd.html

· http://blogs.ft.com/beyond-brics/2013/02/03/the-week-ahead-february-4-8/

A complete overview of all previous editions of Best of the Web can be found here http://tinyurl.com/yb9e5dg. All links provided are collected from public websites, unless otherwise specified. I have not checked the data or information for accuracy used, and therefore do not guarantee that all data provided will be 100% correct. The links provided do not necessarily reflect my personal opinion and should be seen as general interest: oftentimes I do not agree with arguments presented, but nevertheless think it is worthwhile to read them. It is up to the reader to make up their own mind. Suggestions or discussions are more than welcome. Do not quote unless specifically cleared beforehand!