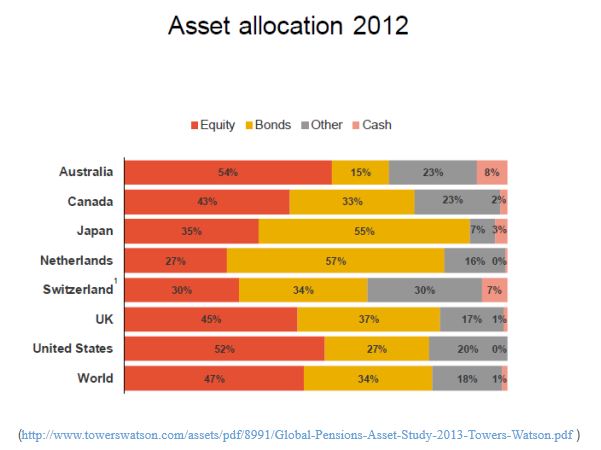

Good morning. Which country is the most heavily invested in bonds when it comes to pensions? Makes you wonder??? From the Global Pension Asset Study

(http://www.towerswatson.com/assets/pdf/8991/Global-Pensions-Asset-Study-2013-Towers-Watson.pdf )

??

Much ado about the Chinese PMI???s released. One (HSBC) was strong, the other (official) disappointed

?????????????????? http://www.businessinsider.com/china-january-2013-official-pmi-2013-1

?????????????????? http://www.ft.com/intl/cms/s/0/01bbcc22-6c1d-11e2-a700-00144feab49a.html

??

January is done! And the winners are???

?????????????????? http://www.bespokeinvest.com/thinkbig/2013/1/31/asset-class-performance-in-january.html

??

Ah yes, the January effect???. No perfect fit for sure, but look at 1987: 13% return in January and flat for the year??

?????????????????? http://www.businessinsider.com/sp-500-january-effect-exceptions-2013-1

??

I have shown this one before, but this is updated. The black bits are the Fed???

?????????????????? http://www.zerohedge.com/news/2013-01-31/feds-ten-year-equivalent-holdings-hit-record-29-entire-treasury-market

??

Some perspective on the debt ceiling: it was raised 15 times since 1996???

?????????????????? http://www.washingtonpost.com/blogs/wonkblog/wp/2013/01/31/weve-raised-the-debt-ceiling-15-times-since-1996/

??

Low volatility stocks are the bestest! (and I can proudly say that Robeco was one of the first to make an investment strategy out of it)

?????????????????? http://www.businessinsider.com/financial-advisor-insights-january-31-2013-1

??

???Currency wars???: that???s what the ???fiscal cliff??? in 2012 was???

?????????????????? http://ftalphaville.ft.com/2013/01/31/1364792/ware-the-currency-wars/

??

Very cool table showing the returns of the various commodities over the years

?????????????????? http://www.businessinsider.com/usfunds-periodic-commodities-table-2013-1

??

Pretty cool ehhh??? something, I guess??? (trades in UNG)

?????????????????? http://www.businessinsider.com/eia-natural-gas-leak-trading-2013-1

??

And this is closely linked to the previous chart: a High Frequency Trading infographic!

?????????????????? http://www.scribd.com/doc/123286545/Infographic-HFT

??

A complete overview of all previous editions of Best of the Web can be found here http://tinyurl.com/yb9e5dg. All links provided are collected from public websites, unless otherwise specified. I have not checked the data or information for accuracy used, and therefore do not guarantee that all data provided will be 100% correct. The links provided do not necessarily reflect my personal opinion and should be seen as general interest: oftentimes I do not agree with arguments presented, but nevertheless think it is worthwhile to read them. It is up to the reader to make up their own mind. Suggestions or discussions are more than welcome. Do not quote unless specifically cleared beforehand!

??

Pingback: Best of the Web in 2013 | Best in Economics